GCP Infra pays down debt in third quarter

GCP Infrastructure Investments Ltd

71.60p

10:24 14/11/24

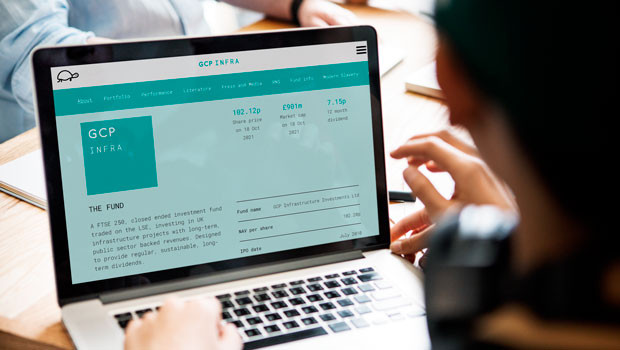

GCP Infrastructure Investments released its latest quarterly investor update on Wednesday, reporting a net asset value of 105.22p per share as at 30 September, with the diversified portfolio valued at about £1bn, comprising 50 investments that included partial inflation protection.

Equity Investment Instruments

12,086.20

10:29 14/11/24

FTSE 250

20,398.86

10:30 14/11/24

FTSE 350

4,442.31

10:30 14/11/24

FTSE All-Share

4,400.08

10:30 14/11/24

The FTSE 250 company said the portfolio offered a weighted average annualised yield of 7.8%, and had an average life of 11 years.

As part of a capital allocation programme initiated in December last year, GCP Infra said it had so far realised around £31m of asset sales, aiming to recycle £150m in total.

The proceeds from the programme were designated for debt reduction and to return a minimum of £50m to shareholders.

It noted that due diligence and negotiations were ongoing for further asset disposals, with detailed net asset value movements to be disclosed in the upcoming annual report in December.

During the quarter, GCP Infra reduced its revolving credit facility, leaving an outstanding balance of £57m and a net debt position of about £45m, down from £51m at the end of June.

At 1252 GMT, shares in GCP Infrastructure Investments were up 0.3% at 71.51p.

Reporting by Josh White for Sharecast.com.