This website is for Private Investors* only

- Obtains access to the information in a personal capacity;

- Is not required to be regulated or supervised by a body concerned with the regulation or supervision of investment or financial services;

- Is not currently registered or qualified as a professional securities trader or investment adviser with any national or state exchange, regulatory authority, professional association or recognised professional body;

- Does not currently act in any capacity as an investment adviser, whether or not they have at some time been qualified to do so;

- Uses the information solely in relation to the management of their personal funds and not as a trader to the public or for the investment of corporate funds;

- Does not distribute, republish or otherwise provide any information or derived works to any third party in any manner or use or process information or derived works for any commercial purposes.

Tell us more

You are seeing these quotes based on previous browsing related to sectors such as

What is spread betting?

When you spread bet you take a position based on whether you expect the price of a product to rise or fall after placing a trade. You will make a profit or loss based on whether or not the market moves in your direction.

Spread betting is a tax-efficient* way of speculating on the price movement of thousands of global financial products, including indices, shares, currency pairs, commodities and treasuries.

Spread betting is a form of financial derivatives trading. With spread betting, you don't buy or sell the underlying asset (eg a physical share or commodity) you wish to trade. Instead you place a bet based on whether you expect the price of a product to go up or down in value. For instance, if you expect the value of a share or commodity to rise in the coming days, you would open a long position (buy). Conversely, if you expect the share or commodity to fall in value in the coming days, you would take a short position (sell).

What is a stake?

With spread betting, you buy or sell a pre-determined amount per point of movement for the product or underlying instrument you are trading, such as £5 per point. This is known as your 'stake' size. This means that for every point that the price of the instrument, let's say Barclays shares, moves in your favour, you will gain multiples of your stake x the number of points by which Barclays' share price has moved in your favour. On the other hand, you will lose multiples of your stake for every point the price of Barclays shares moves against you. Please note that with spread betting, losses can exceed deposits.

What is a spread?

The difference between the buy price and sell price is referred to as the spread. As one of the leading providers of spread betting in the UK, we offer consistently competitive spreads. Tight spreads meanthat the spread you pay is less and therefore that this part of the cost of trading to you is lower. See our Range of Markets page for more information about our spreads.

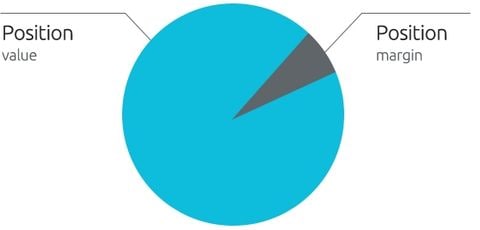

What is margin or leverage?

Spread betting is a financial leveraged product, which means that you only need to deposit a small percentage of the full value of the spread bet in order to open a position (also called 'trading on margin'). While margined (or leveraged) trading allows you to magnify your returns, losses will also be magnified as they are based on the full value of the position and you could lose more than your deposit.

Learn more about margined trading.

Spread betting benefits

Many investors choose to spread bet on the financial markets as spread betting offers a number of benefits over buying physical shares:

- You can sell (go short or short sell) if you think the price of a product is going to fall

- You can trade on margin, so you only need to deposit a small percentage of the overall value of the trade to open your position

- Profits are tax-free*

- You can trade on global share markets, as well as indices, currency pairs and commodities

- There is no separate commission charge to pay on spread bets

- Access to 24-hour markets

- There is no stamp duty* to pay

Understanding what can affect price movements

It's a good idea to keep up to date with current affairs and news because real-world events often influence market prices. To take a historic example, let's look at the Help to Buy housing scheme announced by the UK government on 20 March 2013.

Many believed that this scheme would boost UK home builders' profitability. Let's say you agreed and decided to place a buy spread bet on Barratt Developments at £10 per point just before the market closed.

So in this example, let's say that Barratt Developments is trading at 255 / 256 (where 255 is the sell price and 256 is the buy price). In this example the spread is 1.

Let's assume that on March 20 2013 you opened a long position at £10 per point because you thought the price of Barratt Developments would go up. For every point that Barratts' share price moved up or down, you would have netted a profit or loss x your stake amount.

Outcome A: winning bet

Let's say your prediction was correct and Barratt Developments' shares rose over the next two months to 346 / 347. You decide to close your buy bet by selling at 346 (the current sell price).

The price has moved 90 points (346 sell price - 256 initial buy price) in your favour. Multiply this by your stake of £10 to calculate your profit, which is £900.

Outcome B: losing bet

The price has moved 50 points (256 - 206) against you. Multiply this by your stake of £10 to calculate your loss, which is £500.

See our detailed spread betting examples.

Unfortunately, your prediction was wrong and the price of Barratt Developments' shares dropped over the next month to 206 / 207. You feel that the price is likely to continue dropping, so to limit your losses you decide to sell at 206 (the current sell price) to close the bet.

Losses can exceed deposits where prices move in the opposite direction. Past performance is not indicative of future performance.

^ Prices are taken from our platform. Our prices may not be identical to prices for similar financial instruments in the underlying market.

* Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.