ITM expects losses to widen, shares fall

ITM Power said annual losses were set to widen significantly after the green energy specialist increased investment across the business.

Alternative Energy

0.00

15:10 16/09/24

FTSE AIM 100

3,456.11

17:04 09/01/25

FTSE AIM 50

3,848.01

17:04 09/01/25

FTSE AIM All-Share

719.96

17:04 09/01/25

ITM Power

40.14p

16:34 09/01/25

The AIM-listed firm said adjusted earnings before interest, tax, depreciation and amortisation were expected to be around £36.5m in the year to 30 April, compared to last year’s losses of £21.4m. It noted that EBITDA had been impacted by a £7m investment in training and recruitment, and £14m in project delivery and ramp up costs.

Revenues, meanwhile, are expected to come in at £5.5m compared to £4.3m a year previously. Around £11m of revenue from one contract will now be recognised in the 2023 full year, ITM added.

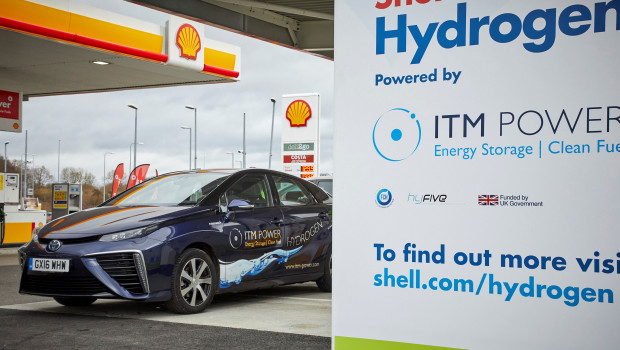

Shares in the firm, a specialist in energy storage and clean fuel, fell sharply on the update. As at 1130 BST, they were off 12% at 254.47p.

Graham Cooley, chief executive, said: "Over the past year, ITM Power has laid the foundations, financially and operationally, to scale our production capacity which will play a critical role in decarbonising economies.

"Russia’s invasion of Ukraine has accelerated the intent of many countries to increase energy and food security, with a specific focus on green hydrogen. We believe we can gain a material share of these global markets as a result of our experience, expertise, partnerships and capacity."

The group also said it had a "record backlog" of work, which stood at 755 mw as at the start of June, a 53% increase since the start of the year. Year-on-year, the backlog is 160% higher. Of that, 75 mw is contracted, 342 is in negotiation and 338 mw is preferred supplier.

The company will announce final results on 8 August.