ITM Power sees 1H operating loss widen sharply, announces strategy changes

ITM Power saw its operating losses bloat over the half as it continued to struggle in its transition from a research and development outfit and into a volume manufacturer at scale.

Alternative Energy

0.00

15:10 16/09/24

FTSE AIM 100

3,499.07

11:55 07/01/25

FTSE AIM 50

3,894.14

11:55 07/01/25

FTSE AIM All-Share

727.89

11:55 07/01/25

ITM Power

40.38p

11:54 07/01/25

For the six months ending on 31 October, the energy storage and clean fuel company posted an adjusted loss before interest, taxes depreciation and amortisation of £54.1, versus £12.9m of red ink during the year earlier period.

Sales meanwhile fell from £4.2m over the comparable 2022 period to £2.0m.

Company chairman, Sir Roger Bone, was clear, explaining that ITM had "underestimated the competencies and capabilities required to scale up and to transition from an R&D company to a volume manufacturer.

"As a consequence, we set unrealistic targets for project completion. This has produced an unacceptable financial performance."

However, the company's recently appointed chief executive officer, Dennis Schulz, expressed confidence in the company's cutting-edge electrolyser technology and balance sheet strength.

Schulz also believed that the company still had a window of opportunity to solve its growing pains.

The company ended the half with £317m of net cash on its books, thanks to a successful capital raise during the period, which was up from £164.2m one year before.

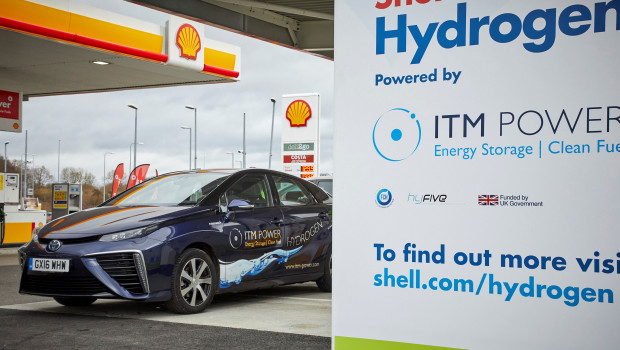

It also announced new strategic measures, including a focus on a core product suite, a 30% headcount reduction that would save it an annualised £9m in personnel costs and the potential disposal or closure of its Motive Fuels joint-venture with Vitol.

The latter was expected to result in approximately £28m of savings that would be channeled into its core business.

Nonetheless, ITM now anticipated that its full 2023 financial year sales would only reach £2m with additional sales deferred into the following financial year.

That would see the company's adjusted EBITDA loss reach £85-95m with net cash at period end put at £245-270m.

The company also announced that Dr. Rachel Smith was to step down from the board.

As of 0902 GMT, shares of ITM Power were trading 5.65% higher to 94.37p.