Berenberg lifts targets for Glanbia on margin growth

Berenberg has raised its target price for Glanbia after the Irish performance nutrition and food manufacturer's forecast-beating interim results last week, as strong margins make up for declining volumes.

Food Producers & Processors

7,196.76

17:04 13/01/25

Glanbia (CDI)

€14.04

16:34 13/01/25

The broker lifted its target from €16.30 to €17.40, keeping its 'buy' rating for the stock, which was up 0.5% at €15.10 on Monday morning.

Glanbia reported on Wednesday that first-half volumes were down 2% year-on-year, much better than the 4.2% decline expected due to a better-than-estimated performance in Nutritional Solutions. Margins rose 110 basis points to 7.2%, ahead of the consensus forecast of 6.6%.

One sore spot was the SlimFast division, where the year-on-year sales decline worsened from -28.3% in the first quarter to -33.8% in the second.

"Despite brand investments and retailer support for the brand refresh, the SlimFast brand – and the diet category overall – have not regained momentum and some US retailers are now reducing category shelf space in the short term, which will reduce distribution for SlimFast into next year," Berenberg said.

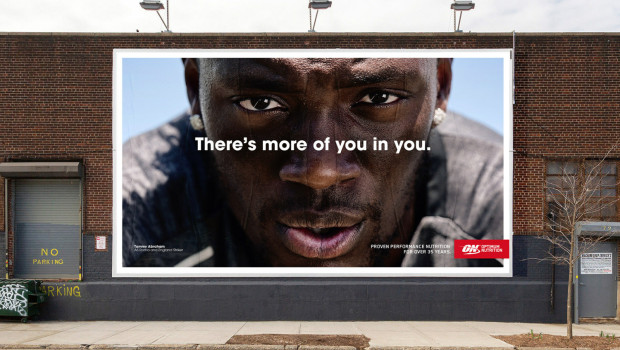

Nevertheless, Glanbia lifted its guidance for margins in its Performance Nutrition department, as a strong performance in higher-margin brands like Optimum Nutrition and Isopure offsets weakness in SlimFast.

"We think that Glanbia has a high level of protection from private label, due to its exposure to sports nutrition, weight management and vitamins. While not immune to brand downtrading, sports nutrition users in particular exhibit above-average levels of brand loyalty."