Friday preview: US inflation data, AstraZeneca in the spotlight

All eyes at the end of the week will be on a slew of inflation indicators due out in the US.

AstraZeneca

10,406.00p

11:40 27/12/24

FTSE 100

8,133.35

11:40 27/12/24

FTSE 350

4,488.08

11:40 27/12/24

FTSE All-Share

4,445.98

11:40 27/12/24

Pharmaceuticals & Biotechnology

19,980.76

11:39 27/12/24

Most investors will be focused on the price deflators for personal consumption expenditures in June due out at 1330 BST which are expected to show inflationary pressures continued to creep higher.

Some economists have recently highlighted the importance for the Federal Reserve of the quarterly employment index, which will be released alongside, labelling it as the US central bank's preferred gauge of nominal compensation.

Also due out, at 1500 BST is a final reading for the University of Michigan's closely-followed consumer confidence gauge for July, including its associated subindices for inflation expectations.

Across the Channel meanwhile, at 1000 BST, preliminary figures from Eurostat are expected to reveal a slight increase in the annual rate of euro area consumer price inflation from 8.6% for June to 8.7% in July.

Another report from Eurostat at that same hour is expected to show that the rate of gross domestic product growth in the single currency bloc slowed from a 0.6% quarter-on-quarter pace over the first three months of 2022 to only 0.1% in the three months to June.

On home shores, at 0930 BST the Bank of England is scheduled to release consumer credit and mortgage lending figures for the month of June.

For AstraZeneca's second quarter results, UBS analyst Michael Leuchten says that top-line momentum for the outfit´s key drugs, Tagrisso, Lynparza and Imfinzi, will be key, alongside the rare disease portfolio brought in by the acquisition of Alexion.

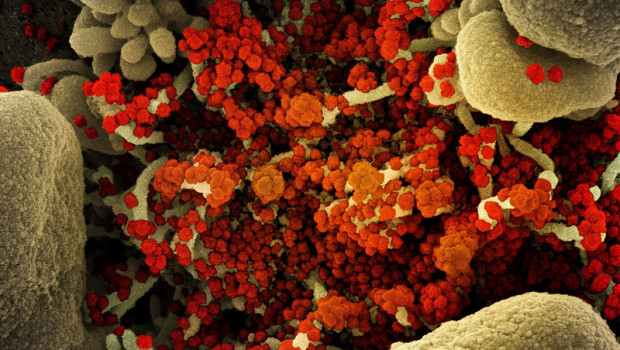

Leuchten also expected the risk from potential disruptions in China should more lockdowns be necessary as a result of the BA.5 coronavirus variant.

The analyst had penciled-in a 31% jump in total sales to $8.22bn for an 82% surge in core earnings before interest and taxes to approximately $1.81bn and core earnings per share of 0.89 US cents.

Thursday 28 July

INTERIMS

Barclays, Centrica, Hammerson, Inchcape, Rathbones Group, Relx plc, Rentokil Initial, Restore, Robert Walters, SEGRO, Shell 'A', Shell 'B', Smith & Nephew, St James's Place

INTERIM DIVIDEND PAYMENT DATE

Compass Group

INTERIM EX-DIVIDEND DATE

Blackrock Throgmorton Trust, Independent Inv Trust, Maven Income & Growth 3 VCT, Maven Income and Growth VCT 5, Moneysupermarket.com Group

QUARTERLY EX-DIVIDEND DATE

NB Global Monthly Income Fund Limited Red Ord Shs NPV £, Tufton Oceanic Assets Limited NPV

INTERNATIONAL ECONOMIC ANNOUNCEMENTS

Business Climate Indicator (EU) (10:00)

Consumer Confidence (EU) (10:00)

Continuing Claims (US) (13:30)

Economic Sentiment Indicator (EU) (10:00)

GDP (Preliminary) (US) (13:30)

Industrial Confidence (EU) (10:00)

Initial Jobless Claims (US) (13:30)

Services Sentiment (EU) (10:00)

Q2

Samsung Electronics Co Ltd (ATT) GDR (Reg S), Shell , Shell 'A', Shell 'B', Smith & Nephew

FINALS

SRT Marine Systems

SPECIAL EX-DIVIDEND DATE

Bytes Technology Group , Tristel

AGMS

Alien Metals Limited NPV (DI), B&M European Value Retail S.A. (DI), CMC Markets, Cyba, Discoverie Group, Eurasia Mining, GB Group, Graft Polymer (UK) , Ingenta, Ingenta, Mediclinic International , Oxford Instruments, Seen, Tate & Lyle, Ted Baker, The Global Smaller Companies Trust

TRADING ANNOUNCEMENTS

Aveva Group, Sage Group, Virgin Wines UK

FINAL DIVIDEND PAYMENT DATE

Anglo Asian Mining, Templeton Emerging Markets Inv Trust, Tribal Group

FINAL EX-DIVIDEND DATE

Bloomsbury Publishing, Bytes Technology Group , Celtic 6% Cnv Cum Prf, Downing One VCT , Heath (Samuel) & Sons, Monks Inv Trust, NewRiver REIT, Northern 2 VCT, Octopus AIM VCT, QinetiQ Group, Quixant, Redcentric, Royal Mail, SSE, Triad Group