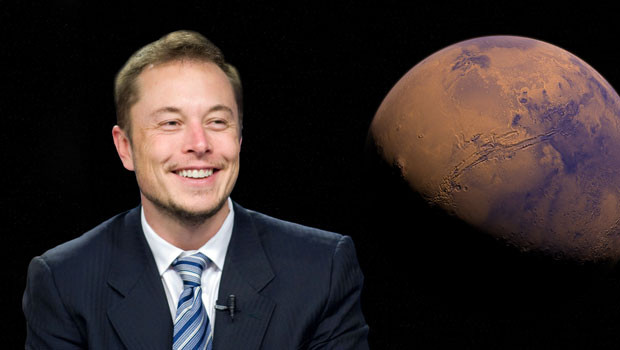

Elon Musk makes $43bn hostile takeover bid for Twitter

Tesla owner Elon Musk has made a $43bn hostile takeover bid for social media company Twitter.

Twitter Inc

$53.70

11:00 24/12/24

According to a filing with the Securities and Exchange Commission, Musk has offered $54.30 a share, which is a 54% premium to the closing share price on 28 January, before he started buying up shares.

Musk took a 9.2% stake in Twitter earlier this month and later declined to take up a position on the board.

In a letter to Twitter’s board, Musk said he believed Twitter "will neither thrive nor serve [its free speech] societal imperative in its current form" and that it "needs to be transformed as a private company".

"If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder," Musk added.

Twitter confirmed in a brief statement that it had received an unsolicited, non-binding proposal from Elon Musk at $54.20 per share in cash.

"The Twitter board of directors will carefully review the proposal to determine the course of action that it believes is in the best interest of the company and all Twitter stockholders," it said.

CMC Markets analyst Michael Hewson noted the speculation about Musk's motives for not taking up a board role.

"Today we found out why he was so reticent, when the Tesla CEO tabled a $43bn, $54.20 cash offer for the business, saying that it was a full and final offer for the business, and that he had no confidence in the current management," he said.

"As a member of the board, he would have been precluded from making such a bid. The big question for the Twitter board now is whether to accept a very generous offer for a business that has been a serial underperformer and tends to treat its users with indifference.

"Twitter has also come under increasing criticism for its arbitrary censoring of accounts that don’t adopt a particular political narrative, as well as the arbitrary nature of how it verifies users, and deals with fake accounts, over genuine users. From customer service to the monetisation of its user base, Twitter has been a serial underperformer for some time. Maybe a shaking up of the status quo wouldn’t be a bad thing!

"Whatever your feelings on Musk he would certainly shake things up, with the only question as to whether he would make things worse or improve them."

Victoria Scholar, head of investment at Interactive Investor, said: "This is a deeply hostile move from Elon Musk who has threatened to ‘reconsider’ his 9.2% stake in the company if his 100% acquisition offer is rejected. Musk has priced his offer attractively at a significant premium to yesterday’s close making Twitter decision even more difficult.

"While shares initially spiked more than 12% pre-market, the stock is now up 6.5% to around $48 a share, suggesting the market isn’t fully convinced the $54.20 a share offer will be accepted. Given that the share price is closer to yesterday’s close than the offer price, the market is pricing in a higher likelihood that the deal is rejected than accepted. Although Musk has said he’s not playing the ‘back-and-forth game’ the question is whether he would up his offer if it is rejected, which is difficult to predict just like Musk himself.

"There has already been some friction between Musk and Twitter employees. Musk described himself as a free-speech absolutist, which goes against Twitter’s deep focus on content moderation through removing trolls, fake news and conspiracy spreading.

"If he were to take control of the company there could be some significant changes with a shift in focus away from content moderation and healthy content sharing towards absolute free speech which Musk says is a ‘social imperative.’ The biggest change however would be that the company would go private, allowing more flexibility and requiring less accountability. Plus we would expect to see the changes Musk outlined over the weekend including allowing users to pay with dogecoin and cutting the price of the Twitter Blue premium service."