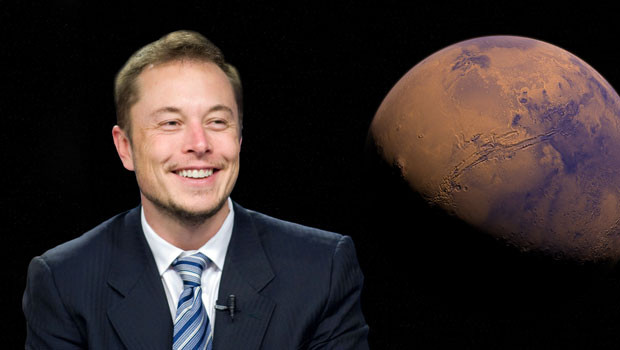

Elon Musk to buy Twitter in surprise climbdown

Elon Musk is to proceed with his $44bn acquisition of Twitter, his lawyers have confirmed, causing shares in the social media platform to surge.

Nasdaq 100

21,797.65

09:15 24/12/24

Tesla Motors Inc

$462.28

12:00 24/12/24

Twitter Inc

$53.70

11:00 18/12/24

In a brief statement filed with the Securities and Exchange Commission late on Tuesday, lawyers for the Tesla and SpaceX billionaire said Musk would now "proceed to closing of the transaction", providing all legal action was halted immediately and pending receipt of the proceeds of debt financing.

Twitter confirmed: "We received the letter from the Musk parties, which they have filed with the SEC. The intention of the company is to close the transaction at $54.20 per share."

Shares in Twitter surged on the news, closing 22% higher on Tuesday at $52.00. As at 1030 BST on Wednesday they were largely flat in pre-market trading.

Musk’s proposed takeover of Twitter has become one of the most fractious deals in recent history.

Musk, widely recognised as the world’s richest man and a prolific tweeter, first started building a stake in Twitter in January. In April he was offered a seat on the board, but turned it down in favour of a surprise $44bn offer for the entire company, which Twitter accepted.

Shortly afterwards, however, he began to dispute the number of spam accounts on Twitter, arguing that the number was likely far higher than the social media company's stated 5%. In May he said the deal was on "temporary hold" over his concerns, before announcing he was walking away in July.

In response, Twitter launched immediate legal against Musk to force him to complete the deal.

Neither Musk nor Twitter provided any explanation as to why the deal would now proceed, although Musk issued a brief tweet noting: "Buying Twitter is an accelerant to creating X, the everything app."

Responding to another tweet, he added: "Twitter probably accelerates X by 3 to 5 years, but I could be wrong."

It is not clear what X is, with Musk yet to provide any details. But analysts believe Musk could be planning to develop something similar to China’s WeChat, the instant messaging, social media and mobile payment app.

Neil Wilson, chief market analyst at Markets.com, questioned if the latest twist was just a delaying tactic, noting: "He was due to be deposed later this week, and Twitter is said to be concerned he’s just running rings around the process to buy more time. Or is it acknowledgment that he didn’t stand a very good change in the court? Must thought Twitter would win and Musk probably agreed after the early exchanges.

"Banks on the hook for the leverage bit of the deal might not be terribly happy, since interest rates have gone up materially since the terms were inked, meaning peddling the debt will be that much harder. And Tesla shares should surely come under pressures as Musk remains on the hook for a hefty sum."

Shares in Tesla, which closed up 3% on Tuesday, were trading down 1% in pre-market trading on Wednesday.

Victoria Scholar, head of investment at Interactive Investor, said: "The timeline of events has solidified Musk’s reputation as unpredictable and unreliable, creating a lot of uncertainty for Twitter’s investors and employees.

"It is likely that if the deal goes through, Musk will take Twitter private, removing it from the public markets to avoid as intense scrutiny from the analyst community and SEC."