Tesla Q1 beats expectations on higher prices, solid demand

Tesla Inc

$398.90

17:14 07/01/25

Electric car maker Tesla has posted a jump in first-quarter profits and revenues, surpassing analysts’ expectations thanks to higher prices and solid demand.

Profits surged to $3.3bn from $438m in the first quarter of last year, on revenues of $18.8bn, up from $10.4bn. Revenues came in nearly $1bn above expectations. Meanwhile, total deliveries rose 68% year-on-year to a record 310,048.

"Public interest in a sustainable future continues to rise, and we remain focused on growing as fast as is reasonably possible," Tesla said, although it added that challenges around the supply chain "have remained persistent".

"In addition to chip shortages, recent Covid-19 outbreaks have been weighing on our supply chain and factory operations. Furthermore, prices of some raw materials have increased multiple-fold in recent months," Tesla said. "The inflationary impact on our cost structure has contributed to adjustments in our product pricing, despite a continued focus on reducing our manufacturing costs where possible."

The company also said it recently restarted limited production in China after a spike in Covid-19 cases meant it had to temporarily shut down its factory in Shanghai and parts of the supply chain. "We continue to monitor the situation closely," it said.

At 1015 BST, Tesla shares were up 7.1% in pre-market trade at $1,046.60.

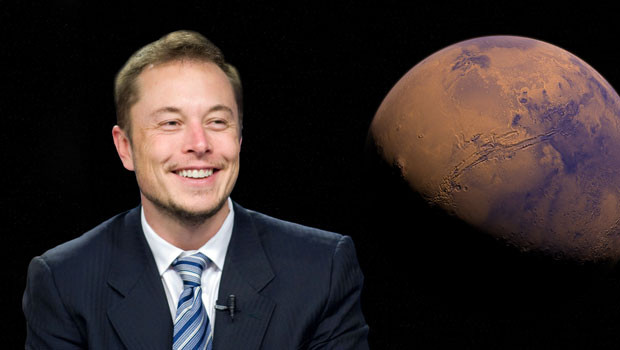

Russ Mould, investment director at AJ Bell, said: "While all the focus may be on its founder’s attempt to takeover Twitter, Tesla shares unsurprisingly charged up after market hours in the US yesterday as it comfortably outpaced quarterly expectations.

"The electric vehicle manufacturer saw a seriously impressive gear change in sales and profit with deliveries surging despite the supply chain issues, including a global microchip shortage, which are dogging the industry.

"Electric vehicles continue to move into the mainstream and it feels you are just as likely to see a Tesla on the road now as almost any other make - with both its Model 3 and Model Y outselling the humble Ford Fiesta in the UK.

"The company may not market its products itself but as prices at the pump gush higher it will concentrate minds on the incentives of going electric.

"Tesla is so synonymous with electric vehicles it can piggy back on rivals’ own spending on marketing and advertising.

"The balance between a higher up-front cost and how much it sets you back to keep a car on the road is starting to tip in Tesla’s favour.

"That said a cost of living crisis and higher interest rates may make it trickier for people to finance Tesla’s prices which still run into tens of thousands of pounds.

"And Tesla shareholders may be somewhat miffed that Elon Musk is potentially going to be distracted by a fractious pursuit of Twitter, just at a time when the business is really starting to accelerate."