Fed hikes 25bp, opens door to possibility of a pause

The Federal Reserve hiked short-term official interest rates as expected, but left the door open to a pause in its tightening cycle.

Banks

4,830.80

17:09 23/12/24

FTSE 100

8,102.72

17:14 23/12/24

FTSE 350

4,471.06

17:09 23/12/24

FTSE All-Share

4,428.73

16:44 23/12/24

HSBC Holdings

765.10p

16:55 23/12/24

In its policy statement, the Federal Open Market Committee also stated that the country's banking system was "sound and resilient", while reiterating its "strong" commitment to inflation returning to its 2.0% target.

Economic growth was modest during the first quarter, yet hiring had remained "robust" and inflation was still "elevated", it added.

"In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments," the FOMC said.

Policymakers also said that tighter monetary policy would likely weigh on "economic activity, hiring, and inflation".

"The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks."

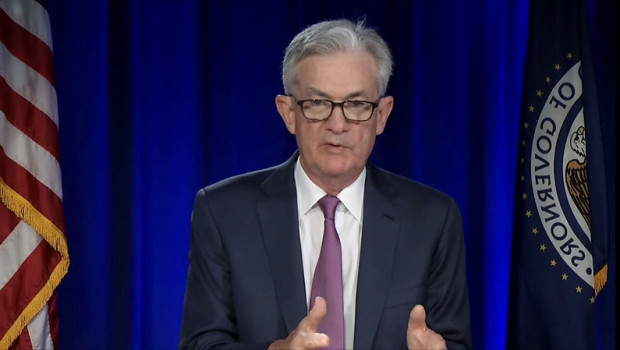

Fed chairman Jerome Powell was set to take to the podium to explain the FOMC's latest decision from 1930 BST.

At the presser, Powell went on to stress how the FOMC policy statement no longer indicated that rate-setters anticipated that further tightening was likely to be needed.

Yet "we are prepared to do more", he added, while also noting that labor demand continued to "substantially exceed" supply.

"The Fed failed early on with inflation due to its grand-scale inaction. It was a hugely consequential miscalculation by the world’s most influential central bank," said deVere Group chief executive officer Nigel Green.

"The Fed has now failed again, making another mistake, this latest interest rate hike, which could push the world’s largest economy not only into a short-term but a longer-term recession.

"Clearly, this would not only be a huge issue for the US, but the global economy too."

For his part, Ian Shepherdson, chief economist at Pantheon Macroeconomics, told clients: "We expect the two rounds of payroll, CPI, PPI and activity data between now and the June meeting to confirm that the economy has weakened markedly and that inflation pressure is receding, so we think the Fed will leave rates on hold.

"Note that it is entirely possible that the debt ceiling situation is at crisis point at the time of the June meeting, with markets in turmoil, adding to the case for the Fed not to act. We think the Fed’s next move will be an easing, in September or November."