Federal Reserve hikes rates by 50bp, raises inflation forecasts

Rate-setters in Washington shifted down their pace of interest rate hikes as expected, even as they pushed back on expectations that monetary policy could start to be loosened in the back half of 2023.

In its policy statement, the Federal Open Market Committee again described job gains over recent months as "robust" while prices were said to still be "elevated".

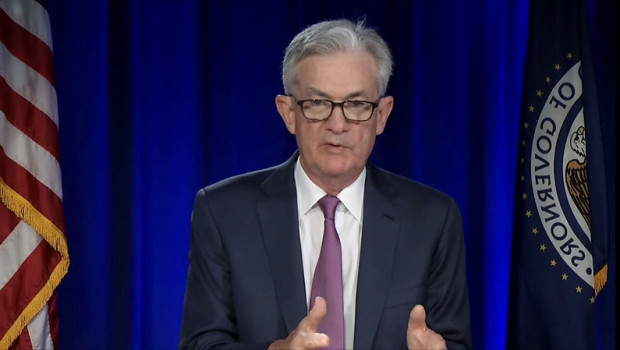

Furthermore, in his post-meeting press conference, Federal Reserve chairman, Jerome Powell, said the central bank would not be looking at cutting rates until it was "confident" that inflation was headed down towards 2% "in a sustained way".

Powell added that the Fed wanted strong wage growth, but at a level consistent with 2% inflation.

The projections from the Fed's top officials, as per the new Summary of Economic Projections, were more hawkish than those submitted in September.

Nevertheless, changes to their forecasts for the Fed funds rate had been anticipated by financial markets for some weeks now.

The median projection for the Fed funds rate in 2023 was now at 5.1%, half a percentage point more than in September, yet the Fed's target inflation gauge was now seen falling by less over the course of the following year.

In September, the price deflator for personal consumption expenditures was seen falling from 4.5% for 2022 to 3.1% in 2023.

Now however core PCE prices were seen slipping from 4.8% to 3.5%.

Come 2024 core PCE prices were seen retreating further to 2.5%.

GDP growth on the other hand was now expected to clock in at only 0.5% in 2023, against a prior projection for a rate of expansion of 1.2%.

In parallel, unemployment was expected to rise to 4.6% in 2023-24, versus 4.4% beforehand.

Commenting on the latest SEP, Ian Shepherdson, chief economist at Pantheon Macroeconomics, said: "We are baffled. The inflation forecasts suggest either that the Fed has lost faith in the idea that margin compression will drive down inflation - even though Vice Chair Brainard made this point forcefully just a few weeks ago - or that it is less confident that higher unemployment will reduce wage inflation, or both.

"We see no reason to make these judgments in light of the data released since the September forecast round, and we are strongly of the view that inflation will substantially undershoot the Fed’s forecasts next year."