Stocks jump as Fed shifts to meeting by meeting approach

US monetary policymakers shifted back towards a meeting by meeting approach to setting interest rates on Wednesday, instead of offering explicit guidance on the magnitude of their next move.

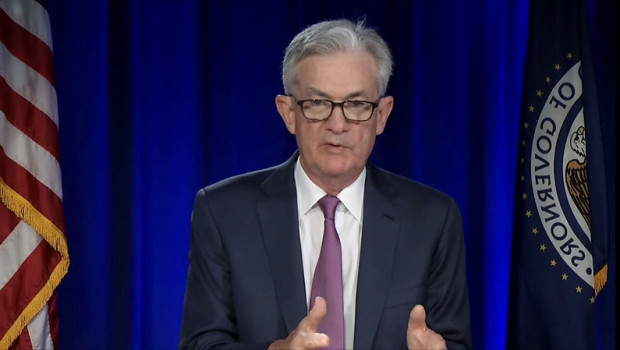

In his post-meeting press conference, Federal Reserve chairman, Jerome Powell, also said that at some point it will likely become appropriate to slow the pace of rate increases "while we assess how our cumulative policy adjustments are affecting the economy and inflation".

On this point, Mickey Levy at Berenberg Capital Markets noted how the Fed had been aggressively front-loading its policy tightening.

A slower pace of hikes going forward had already been widely anticipated by market observers and Fed funds futures.

Yet judging by the reaction in financial markets, Powell appeared to catch traders on the hop, with Wall Street's main equity indices running up sharply on the back of his remarks, very short-term Treasury yields falling and the Greenback beating a hasty retreat.

The S&P 500 put on 2.62% to end the session at 4,023.59, while the Nasdaq Composite soared 4.0% to 12,032.42.

Yields on three-month Treasury bills were off by 10 basis points to 2.41% and those on the benchmark 10-year note edged lower by one basis point to 2.795%, having earlier hit 2.729%.

Euro/dollar was up by 0.80% at 1.0198.

Powell did leave the the door open to a third consecutive 75 basis point interest rate hike for the 20-21 September meeting.

Nevertheless, Fed funds futures had already priced-out that possibility before Wednesday's press conference.

In its monetary policy statement, the Federal Open Market Committee reiterated that "the Committee is highly attentive to inflation risks and that it "is strongly committed to returning inflation to its 2 percent objective."

Yet as of 2056 BST, Fed funds futures had also trimmed their expectations for December's policy meeting, assigning roughly 30% odds to the target range for the Fed funds rate remaining unchanged at 3.25-3.50% after that meeting, up from about 20% two days before.

At least for the time being, implicitly, Fed funds futures were thus ruling out a rate hike at the turn of the year with November's hike expected to be the last.

Amid a recent spate of weaker economic data, a growing number of voices had been urging rate-setters at the Fed to be more wary regarding the risks of a recession.

Among other considerations however, economists appeared to be divided as to just how sticky inflation would prove to be and hence in their forecasts for rates.

For his part, Powell said that ultimately policy would be set at the level at which the committee was confident that inflation was headed back down towards the Fed's target level of 2.0%.

He also pushed back against talk that the US economy was in recession, highlighting the "very strong labor market".

"Demand is still strong and the economy is still on track to continue to grow this year."

Commenting on the Fed's policy statement, Ian Shepherdson, chief economist at Pantheon Macroeconomics, noted how the Fed had made no reference to the drop in commodity prices in recent weeks and how it dropped the line regarding the threats to supply chains from China's spring lockdowns.

"Again, the Fed is not yet ready to pivot," he mused.

"[...] We expect this to change on the back of the data over the next few months, so we’re looking to Jackson Hole - August 25 to 27 - as the prime opportunity for the Fed to shift the needle on September expectations."

"Chair Powell’s focus on the need to cool labor demand likely reflects the Fed’s concerns that nominal wage growth remains elevated at levels inconsistent with the Fed’s 2% inflation target," Levy chipped in.

"Elevated nominal wage growth would skew inflationary risks to the upside, particularly given the shift in consumer demand from goods to the labor intensive services sector. Should the Fed’s preferred gauge of nominal compensation, the Employment Cost Index, indicate nominal wage growth remained elevated in Q2, it would likely prompt the Fed to maintain its current aggressive policy tack."