US durable goods orders plummet as those for jets more than halve

Durable goods orders shrank rapidly at the start of 2024, but mainly due to a more than halving in those for defence aircraft and parts.

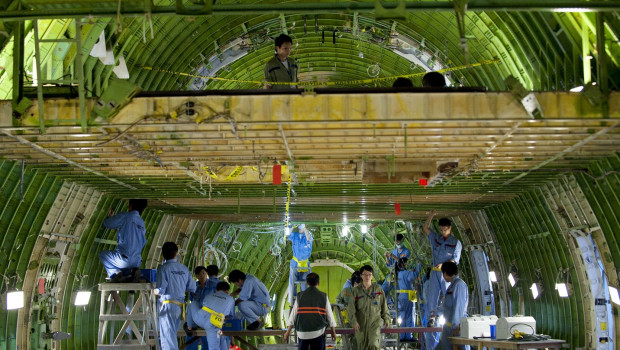

Boeing Co.

$177.35

11:10 20/12/24

Dow Jones I.A.

42,840.26

04:30 15/10/20

According to the Department of Commerce, in seasonally adjusted terms durable goods orders dropped at a month-on-month pace of 6.1% in January to reach $276.65bn (consensus: -4.5%).

That was on top of a downwards revision to the previous month, from an initially flat reading to -0.3% when compared with December.

Total durable goods orders were off by 0.8% when compared with the same month one year before.

However, if those from the transportation sector were excluded then January's decline was a more pedestrian 0.3% over the month (consensus: 0.2%), although December's reading was revised lower by seven tenths of a percentage point to -0.1%.

Non-defence aircraft accounted for nearly the entire decline in total orders, shrinking by 58.9% to $13.73bn.

Orders for motor vehicles and parts meanwhile dipped 0.4%, those for primary metals by 1.7% and those of fabricated metal products by 0.9%.

Computers and electronic products orders however registered a jump of 1.4%.

Non-defence capital goods orders excluding aircraft, a widely tracked lead indicator for business investment, edged up by 0.1% on the month but were 0.2% lower in annual terms.

Commenting on the latest orders data, Olivia Cross, North America economist at Capital Economics, noted how it took nearly a year for lower jet orders to translate into decreased output.

Indeed, non-defence capital goods shipments, excluding aircraft, rose by 0.8% on the month.

Those figures, she said, suggested "that – even allowing for a dip in aircraft investment, business equipment investment could still strengthen in the first quarter."