Market buzz: FTSE erases most losses, Greene King unfairly treated?

1647: After an up and down day, the FTSE 100 finished largely sideway, down just six points at 7,615.63, a fall of just 0.08% in the end.

Banks

4,917.32

16:54 03/01/25

FTSE 100

8,223.98

16:59 03/01/25

FTSE 350

4,534.15

16:54 03/01/25

FTSE All-Share

4,490.88

17:14 03/01/25

Lloyds Banking Group

54.36p

17:11 03/01/25

The falling pound helped the outwardly focused index.

Bank of England chief economist and policymaker Andy Haldane stated a 0.25% rise in interest rates would still leave the monetary conditions ‘extraordinarily accommodative’, setting up a potential hike in August, though the comment failed to turn around sterling’s negative move.

1631: Visa and Mastercard are close to settling a multibillion-dollar lawsuit over the fees US retailers and other companies pay to accept their cards.

Mastercard has put out a statement saying its to increase reserves by $210m “as a result of advances in negotiations” with merchants, while Visa said it has set aside $600m.

1620: Greene King has been one of the biggest losers today, down 9%. Pub like-for-like sales fell 1.2% excluding the impact of snow in March but have revived to show a 2.2% increase in the last eight weeks.

The company is cutting costs but those efforts will be outstripped this year by cost pressure from the National Living Wage, the sugar tax, utilities and business rates even as customers demand more for their money. Greene King said it expected to cut £30-35m of spending this year and to be hit by £45-50m of cost rises.

CEO Rooney Anand said efforts to improve service and food, including more regular food checks and linking staff incentives to online reviews, had started paying off in the second half of the year.

Here's some different view.

Russ Mould, investment director at AJ Bell, said Greene King's performance last year compared badly with rivals Fuller's, where revenue rose 5%, and Young's, whose sales rose 3.9%. Mould said: "Yes, competition is tough in the casual dining industry, but consumers are still choosing to eat out at destinations where they see good value. The recent sunny weather should have helped all pub companies but management at Greene King can’t rely on a few good weeks to revive earnings growth."

Canaccord analyst Nigel Parson, who rates Greene King shares as 'hold', was more forgiving. He said the company was scrapping unwanted brands and reorganising its pubs after buying rival Spirit in 2015 and that cost inflation was starting to ease. Parson said: "Greene King is enjoying a good start to the year … We are not overwhelmed with euphoria but the hot weather and England's serene progress (so far) in the FIFA World Cup is helping. Greene King is now cautiously optimistic and that also neatly summarises our view."

Citigroup left its FY19 PBT forecast essentially unchanged at £247m with EPS of 63.7p, saying: "The recent LFL growth, robust cost saving program and sustainable 5% dividend yield leave the shares well underpinned at current levels. We leave our DCF derived 730p target price unchanged and retain our 'buy' recommendation.

With the continued macro uncertainties around the UK consumer, Citi has 'sell' recommendations on EI Group, Mitchell & Butlers and Marstons, "where we see significant ongoing risks around financial leverage".

1606: European markets have led the way lower this afternoon with the threat of a breakdown in trade disproportionately hurting stocks in countries which enjoy a sizeable trade surplus with the US.

"The continued deterioration in the Chinese yuan highlights the influence the Chinese government has upon their exchange rate, with the 5% rise in USD-CNH over the past two months shifting the trade of terms before any tariffs even start to kick in," says market analyst Josh Mahony at IG, observing that Brexit concerns continue to dominate UK sentiment, with the pound falling to a seven-month low against the dollar.

"However, much of the story is related to the growing prominence of the US dollar, with the greenback likely to continue gaining ground as the trade war continues. With the likes of the EU and China holding huge surpluses in the trade of goods with the US, Trump knows they have more to gain than to lose. The sharp deterioration in German stocks this week is a clear nod to the reliance the country has upon physical exports."

1538: BAE Systems has won a contract with the Australian government, which has selected Type 26 anti-submarine warfare frigate design for their SEA5000 programme.

Stephen Phipson, chief executive of EEF, the manufacturers’ organisation, said: “This win for BAE Systems and the UK defence industry is the result of years of hard work with government and industry working in close partnership.”

1454: US first-quarter GDP has been downwardly revised, providing a temporary dent in the dollar resurgence.

GDP came in at 2%, rather than the 2.2% previously expected. However, recent US PMI surveys points towards continued upside for US growth, so this is likely to be a short term blip.

1444: In his speech before the Academy of Social Sciences, the BoE's chief economist, Andy Haldane, said that his decision to vote for a 25bp hike at the last MPC meeting should not be considered "radical" given how a decade had passed since Bank had adopted its emergency policies.

He also mentioned the lifting of the public sector pay cap for NHS, saying it may well have 'knock-on' effects, both in the remainder of the public sector as well as in the private sector, given how tight the jobs market was.

1443: This is interesting, courtesy of strategists at BofA Merrill Lynch: "If US-EU trade tensions escalate, we would view it as akin to pitting Europe vs. Europe. The US trade deficit with the EU-28 is far from homogenous.

"Germany exports cars to the US…but France doesn't, and while Italy is a net exporter to the US, the Netherlands is a net importer. Therefore, growing trade tensions are likely to further fragment the Eurozone, just at a time when ECB QE is drawing to a close."

1349: US equity futures have turned around to trade lower in the pre-market.

Dow Jones: -133.0 to 24,002.0; S&P 500: -11.5 to 2,693.50; Nasdaq-100: -41.0 to 6,957.25.

1348: While commenting on the outlook for Emerging Market stocks, Credit Suisse says that Latam currencies look "too cheap", bringing to mind Santander, while some consumer staples companies - such as Diageo - have "attractive" exposure to GEMs and "appear less disrupted and have less leverage".

1330: Initial US unemployment claims for the week ending 23 June rose by 9,000 to 227,000 (Barclays: 220,000).

US Q1 GDP revised down from 2.2% to 2.0%.

1206: On the risk of protectionism, on top-tier investment bank says it expects a trade deal between China and the US because the latter has three times as much foreign direct investment in the Asian giant.

1039: The European Commission’s economic sentiment indicator for the U.K. fell to 106.9 in June from 107.4 in May, well below its 12-month average of 109.2.

The headline ESI for the Eurozone fell to 112.3 in June from 112.5 in May, above the consensus of 112.0. The business climate indicator declined slightly to 1.39 from 1.44, while industrial confidence remained unchanged.

The fall in the UK's ESI sub-index was driven by a decline in confidence among services firms to a seven-month low, while the seasonally adjusted consumer confidence indicator, which comes a day ahead of GfK’s index, also weakened to its lowest level since December.

This signals that the economy hasn’t bounced back in the second quarter as strongly as the Bank of England expected, says Pantheon Macroeconomics. "Consumers have become more pessimistic about the outlook for the economy and, to a lesser extent, their own personal finances. Notably, the largest majority of households since July 2016 expect unemployment to rise over the next year. In addition, the proportion of households planning to save more over the next year remained well above average, indicating that growth in spending will lag behind incomes ahead."

At a regional level, the ESIs for Central and Eastern Europe were weaker in Q2 than in Q1. This supports Capital Economics' view that regional GDP growth peaked in Q3 2017.

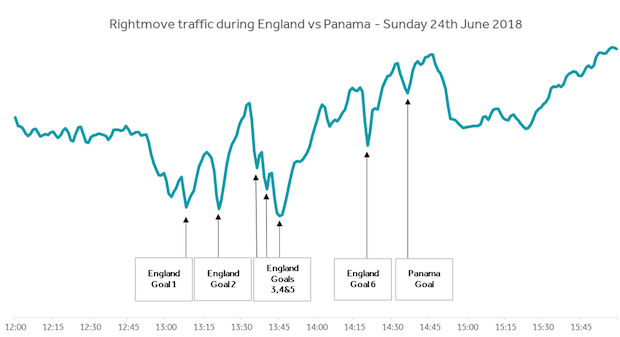

1010: Rightmove have sent out a chart showing that the British/English obsession with property can only be dimmed (for a short time) by World Cup goals.

The chart shows traffic dips at the exact minute each goal was scored during Sunday’s England vs Panama game, as England fans also browse on their phones or laptops for a new house.

Rightmove’s commercial director Miles Shipside says: “The nation’s obsession with property and the rise of dual-screening on mobile and tablets can clearly be seen on Rightmove when there is a significant sporting or national event [...] On this occasion once the full-time whistle was blown there was time for a quick celebration before traffic returned to usual Sunday patterns.”

0957: Although overall they retain a "cautious" approach towards the banking sector, in a research note sent to clients analysts at JP Morgan Cazenove highlight Lloyds's 6.5% dividend yield for 2018 and "limited earnings risk" and StanChart's attractions as a "recovery play".

0935: The reaction of Asos investors to the US sales tax has been overdone, says Citi, but it has cut its target price for the online retailer due to lower growth assumptions.

The retailer's margin targets are "challenging" and its balance sheet position creates risk, being free cash flow negative until at least 2020, net cash of £40m and a £150m debt facility. "With only eight months capex requirement covered by this debt, the risk of e,rgencuy financing if Asos's sales growth is less than expected is heightened."

Given similar growth profiles, along with better cash-flow profiles and stronger balance sheets, we refer Zalando and Boohoo int he European apparel e-commerce space."

Citi reduced its target price to £70 from £77.50 as it cut its forecasts for growth.

0920: “The idea of one of Britain’s biggest pub companies going ex-growth may seem unlikely, yet that’s exactly what’s happened to Greene King," says Russ Mould, investment director at AJ Bell.

"Revenue down 1.8% in the year to 29 April and no dividend growth for the first time in ages would suggest the business needs to take a long hard look at its proposition."

The company has blamed slower food sales which is the opposite message from many other pub companies.

"Yes, competition is tough in the casual dining industry, but consumers are still choosing to eat out at destinations where they see good value. The recent sunny weather should have helped all pub companies but management at Greene King can’t rely on a few good weeks to revive earnings growth. They need to think longer term and focus on core strengths.”

0840: The Just Eat capital markets day, which saw the share price fall 7% yesterday, "was a cautious affair and the warning on margin progression in Marketplace should feed through to lower consensus market forecasts" say analyst Nigel Parson at Canaccord.

"The Just Eat pitch was strangely not compelling, with the messaging shifting from extolling the profit opportunities of [quick service restaurant] to 'a broader range for customers' and 'halo effect for Marketplace' Just Eat said a key justification is that over 90% of QSR delivery customers go on to order from Marketplace. All this just tells us that the cost of acquisition has gone up, matched by an increase in complexity. It's much harder to capture scale efficiencies from last mile delivery or make a profit as labour is such a major cost line. Growing regulatory interest in the 'gig economy' suggests it is a cost that is going to rise."

Canaccord's 700p target price is based on circa 40 times PE for FY18. "We have sought to capture the risk in our forecasts and the upside in our target price multiple and we admit this is a little more art than science as we enter a period of considerable uncertainty for the stock."

0837: Thursday's London open market report shows stocks down in early trade, taking their cue from a late selloff in the US amid ongoing trade war concerns.

The FTSE 100 has started down 0.4% to 7,588.88, while the pound was off 0.1% against the euro at 1.1334 and 0.2% lower versus the dollar at 1.3083.

0830: Overnight, Wall Street performed a U-turn, starting higher but ending lower. Initially investors welcomed an apparent softening of President Trump's stance on China after he suggested he might use the Committee on Foreign Investment in the US to monitor the country's investment in key US sectors, rather than implement tough new measures aimed specifically at China.

However, the mood quickly soured after White House economic adviser Larry Kudlow said in an interview with Fox that Trump's announced plan did not signal a softened stance. "It's not meant to be harder or softer," Kudlow said. "It's going to be very comprehensive and very effective at protecting our technological family jewels in the United States."