US pre-open: Quiet start expected as markets await Powell speech

Futures on Wall Street were pointing to a subdued start on Friday, following heavy losses the previous session, as investors waited with caution for news coming out of the Jackson Hole Economic Symposium.

The Dow Jones Industrial Average, S&P 500 and Nasdaq were all trading just 0.1-0.2% higher in pre-market trade.

The indices lost between 1.1% and 1.9% on Thursday, with the tech-heavy Nasdaq slumping the most as the earlier optimism surrounding a forecast-smashing quarter from Nvidia quickly lost steam.

Hype around Nvidia's results had been lifting sentiment earlier in the week with the AI computing giant being viewed as a bellwether for the wider tech sector.

"The Nvidia-led AI boost appears to have been short-lived, with the Nasdaq leading US markets sharply lower yesterday. Instead, the narrative now shifts toward the ongoing Jackson Hole symposium, with appearances from a number of central bank Governors bringing potential volatility as we close out the week," said analyst Joshua Mahony from Scope Markets.

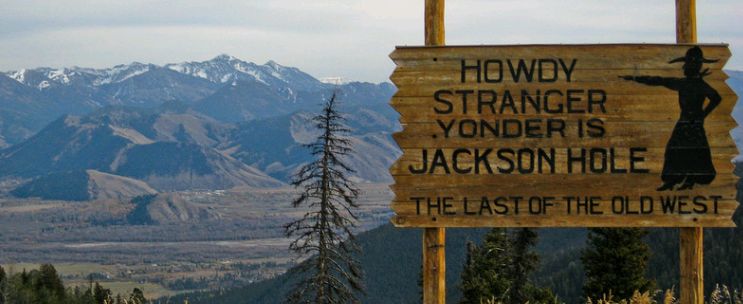

The three-day conference, which began in Wyoming on Thursday, brings together central bankers from around the world. But Fed chair Jerome Powell in particular will be closely watched as he makes a speech at 1005 ET.

"Powell sparked major volatility last year when doubling down on their pledge to stifle inflation despite the negative economic implications," Mahony said. "This time around the focus will be geared towards gaining a greater understanding over the length of time interest rates will have to remain elevated."

European Central Bank president Christine Lagarde is also due to make an announcement later on.

No major economic data was due for release during Friday's trading session, while company news is likely to be thin on the ground.

Nvidia futures were pointing to small gains in pre-market trade, as the stock continues to trade at record highs following its stellar second-quarter results announced on Wednesday.

Luxury department store group Nordstrom slipped after the closing bell on Thursday despite beating forecasts with its second-quarter results. Sales, however, still fell 8% on last year, as the company kept its guidance for a 4-6% full-year top-line decline.

Retail peer Gap also reported an 8% year-on-year drop in quarterly sales.