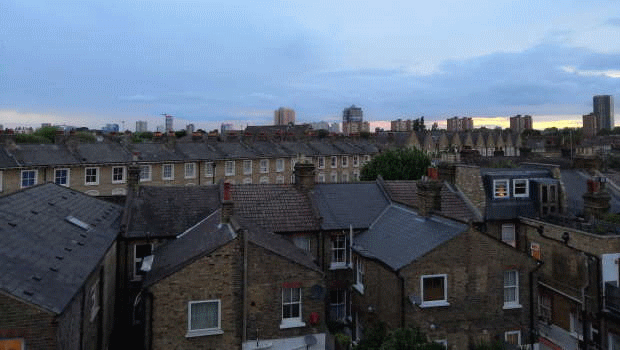

UK house prices ease in May - RICS

UK house prices fell in May, an industry survey showed on Thursday, as the market's recovery lost momentum.

According to the Royal Institution of Chartered Surveyors’ May Residential Market Survey, the net house prices balance slid to -17 from -7 in April. It marked the lowest reading since January.

New buyer enquiries fell to the lowest since November, with a balance of -8 compared to -1 a month previously. The number of agreed sales were also down sharply, falling to -13 from 4.

However, expectations for the coming months remained robust, with a balance of 43 anticipating an increase in sales activity over the next year, up from 33 in April.

Tarrant Parsons, RICS senior economist, said: "The recent recovery across the UK housing market appears to have slipped into reverse of late, with buyer demand losing momentum slightly on the back of the upward moves seen in mortgage rates over the past couple of months.

"Nevertheless, expectations point to this delaying, rather than derailing, a modest improvement going forward."

Up until recently, economists had widely expected the Bank of England to start cutting interest rates in June.

However, with the most recent inflation data coming in stronger than expected, most do not now expect the first cut until August. The cost of borrowing currently stands at a 16-year higher of 5.25%.

Justin Young, RICS chief executive, said: "Today’s data reveals that confidence in the housing market is beginning to dip – just as parties launch their manifestos.

"Greater attention must be paid to improving conditions for Generation Rent, who are faced with rising rents and a lack of suitable options.

"The housing market needs policies that think longer term, and awareness that the different tenures are interlinked, so there is no one solution that will fix the situation."

Tenant demand jumped notably, the survey showed, with the net balance rising to 35 from 10. New landlord instructions were flat, however.

A net balance is the proportion of respondents reporting a rise minus those reporting a fall.

The May survey was based on responses from 252 chartered surveyors operating in residential sales and lettings markets.