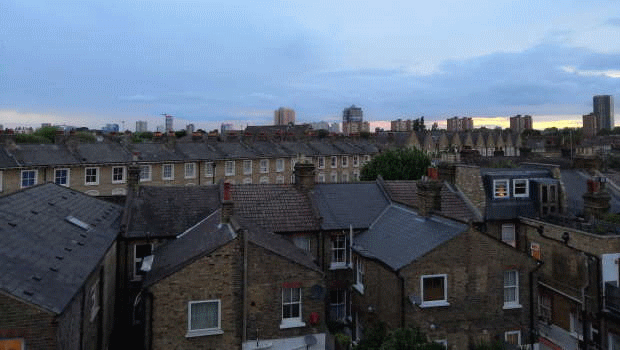

UK house prices grow for tenth-straight month

UK house prices grew 1.1% month-on-month in April to another new record, according to Halifax's house price index, but the rate of house price growth was projected to slow as incomes remained squeezed.

The average UK house price rose to £286,079 in April, marking a tenth consecutive monthly rise, the longest run since 2016. The rate of annual growth fell slightly to 10.8%, down from 11.1% in March, though Halifax said this partly reflected the strength of the market 12 months ago.

Average house prices are now £47,568 higher over the last two years - an increase it took five and half years to make between October 2014 and April 2020 - as average house prices have fallen in just four months since the start of the Covid-19 pandemic.

Northern Ireland overtook the South West of England as Britain's strongest performer in terms of annual price house inflation, now at 14.9%, its highest rate of annual growth since December 2007, while the rate of annual house price inflation in London continued to lag the rest of the UK, with prices up by 6.2% year-on-year.

Martin Beck, EY ITEM's chief economic advisor, said: "There is cause to think house price increases could shortly run out of fuel. The squeeze on real incomes from high inflation means fewer people will be able to afford to borrow the necessary amount they need to buy at higher mortgage rates."

Beck also noted that consumer confidence, including households' expectations of their own personal finances, fell to a near-record low in April and said the rise in the Bank of England's rate announced in this week's MPC meeting was also likely to push up the cost of mortgages and weigh on house prices.