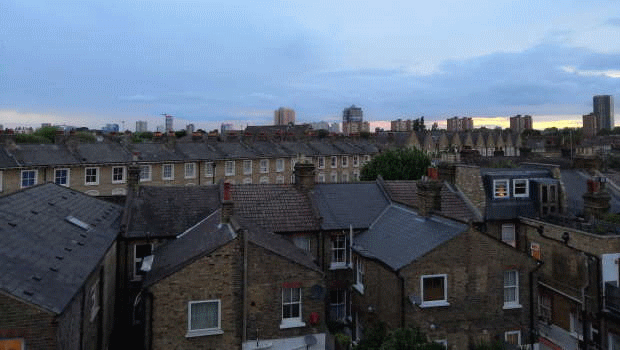

UK house prices rise in February as mortgage rates decline

UK house prices rose in February as mortgage rates fell and consumer confidence improved, according to the latest data released on Tuesday by Halifax.

Prices increased 1.1% on the month in February following a 0.2% rise the month before, to £285,476.

On the year, meanwhile, house price growth was unchanged at 2.1% last month. This was the third month in a row that annual growth was unchanged.

The survey showed that the rate of annual growth slowed in all nations and regions during February.

Kim Kinnaird, director, Halifax Mortgages, said: "Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labour market are arguably helping to stabilise prices following the falls seen in November and December. Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.

"In cash terms, house prices are down around £8,500 (-2.9%) on the August 2022 peak but remain almost £9,000 above the average prices seen at the start of 2022 and are still above pre-pandemic levels, meaning most sellers will retain price gains made during the pandemic. With average house prices remaining high housing affordability will continue to feel challenging for many buyers."