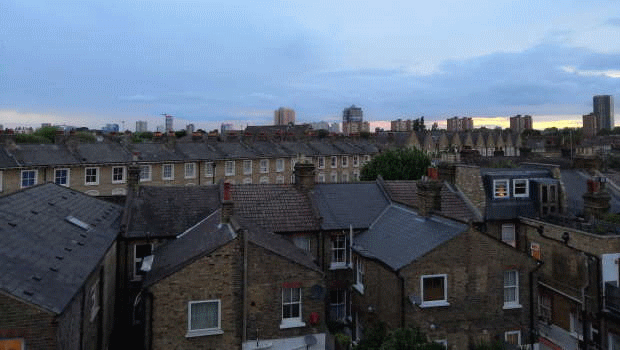

UK house prices suffer worst annual decline since 2009 - Nationwide

UK house prices suffered their sharpest year-on-year decline in 14 years in August, amid rising borrowing costs, according to data released on Friday by Nationwide.

House prices fell 5.3% on the year following a 3.8% decline in July and versus expectations of a 3.9% drop. On the month, they were down 0.8% in August following a 0.3% dip the month before. Analysts were expecting a more modest 0.4% fall.

The average price of a home stood at £259,153, down from £260,828.

Nationwide chief economist Robert Gardner said: "The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels. For example, mortgage approvals have been around 20% below the 2019 average in recent months and mortgage application data suggests the weakness has been maintained more recently.

"Nevertheless, a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters’) expectations."

Andrew Wishart, senior property economist at Capital Economics, said: "With mortgage rates set to remain between 5.5% and 6.0% for the next 12 months, and second-hand supply on the market becoming less tight, we think the August data marks the start of a significant further drop in house prices.

"Indeed the RICS survey, which is the best leading indicator of house prices, is consistent with house prices falling by a similar amount month-on-month for the next five months at least."