Anglo's De Beers sees diamond sales jump in first sale of 2024

Anglo American

2,381.50p

12:40 24/12/24

De Beers, the diamond division of mining giant Anglo American, has reported encouraging further signs of stabilisation in the diamond market after a big jump in revenues from its first sales tender of the new financial year.

FTSE 100

8,136.99

12:59 24/12/24

FTSE 350

4,491.87

12:54 24/12/24

FTSE All-Share

4,449.61

13:14 24/12/24

Mining

10,237.67

12:54 24/12/24

The company said it sold $370m of rough diamonds in the cycle one tender, down from $454m in same cycle one tender last year but well ahead of the $137m sold in the last sales cycle of 2023.

Al Cook, De Beers chief executive, said: "Solid consumer demand for diamonds in the United States over the year-end holiday season has certainly helped to stabilise the industry and we are seeing polished diamond prices increasing again."

Sales have been falling sharply since the spring of 2023, down to a low of $80m in cycle nine (November), compared with $540m in cycle three (April).

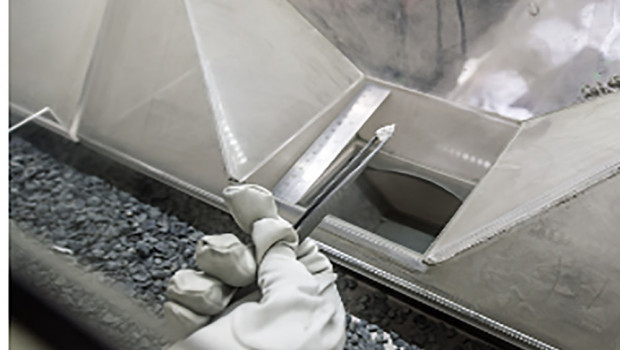

De Beers traditionally sells 90% of its stones by value through Sightholder sales. The sales events, known as Sights, are held 10 times a year. The other 10% of its diamonds are sold via auctions.

The company has blamed "macro-economic challenges" and a slow retail recovery in China for the big drop in prices in 2023. There was also the voluntary two-month moratorium by major diamond producers to curb supply to the Indian market, which was lifted in December, aimed to bring some stability to the market and support to prices.

"Combined with the restart of rough diamond imports into India, this has led to demand for rough diamonds increasing substantially in the first sales cycle of 2024. However, as the prospects for economic growth in many major economies remain uncertain, we expect that it may take some time for rough diamond demand to fully recover," Cook said.