Energean shares fall on production guidance cut

Energean

988.50p

17:15 23/12/24

Eastern Mediterranean gas producer Energean cut production guidance and said it expected to make a final investment decision on its Olympus fields off Israel by the end of this year.

FTSE 250

20,419.09

17:09 23/12/24

FTSE 350

4,471.06

17:09 23/12/24

FTSE All-Share

4,428.73

16:44 23/12/24

Oil & Gas Producers

7,677.43

17:09 23/12/24

Guidance for year was reduced to 125,000-140,000 barrels of oil equivalent per day from 131,000-158,000 due revised gas sales to Israel and higher-than-expected output declines in Egypt.

Revenues for the quarter to March 31 were $288.8m, up 69% year on year. Core earnings rose 81% to $162.2m. Shares in the company fell 8% on the news.

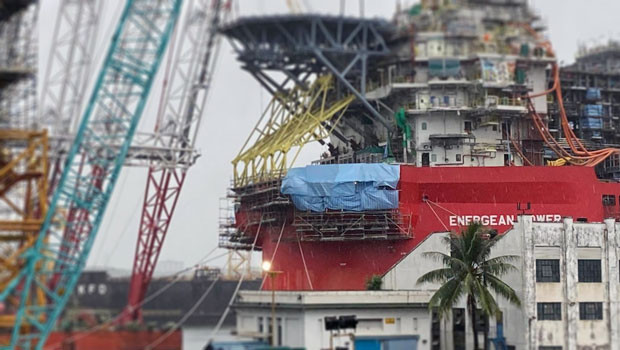

Energean operates a floating production storage and offloading (FPSO) vessel off Israel, supplying that country’s market from its Karish offshore field, which started operations last October.

The Olympus field would connect to the FPSO and deliver to the Israeli market under existing contracts, with any excess gas going to Egypt and Jordan.

Its development has taken precedence over the Tanin gas field, which is set to stay undeveloped into the 2030s, Energean said.

Reporting by Frank Prenesti for Sharecast.com