Energean hails 'strong' quarter, trims production outlook

Energean

870.00p

17:15 28/03/25

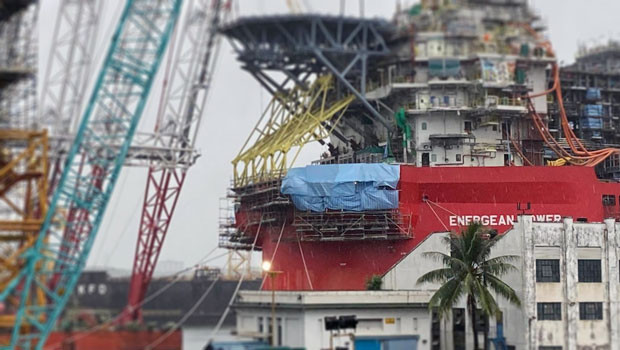

Energean called third-quarter trading "strong" on Thursday, with improved earnings and a jump in production, despite conflict in the Middle East.

FTSE 250

19,864.98

17:14 28/03/25

FTSE 350

4,722.51

17:14 28/03/25

FTSE All-Share

4,671.27

16:39 28/03/25

Oil & Gas Producers

8,829.40

17:14 28/03/25

Updating on trading for the nine months to 30 September, the Mediterranean-focused oil and gas firm said group production was 156,000 barrels of oil equivalent a day, a 31% jump on the previous year.

Adjusted earnings before interest, tax, depreciation, amortisation and exploration expenses from continuing operations was $706m, a 61% increase.

Mathios Rigas, chief executive, said: "We are pleased to announce another strong quarter.

"Our production in Israel remains unaffected by geopolitical events, recording a 39% year-on-year increase, and we welcome the announcement of the ceasefire in Lebanon."

However, looking to the full year, London-listed Energean said total production from continuing operations would likely come in between 110,000 and 115,000 boed, down on previous guidance for between 115,000 and 125,000 boed.

"The reduction is due to Israel," Energean said, "which reflects lower-than-expected sales in November owing to weather conditions and market dynamics and, for the lower end, an assumption of flat month-on-month sales for December."

In June, Energean agreed to sell a portfolio of projects in Italy, Egypt and Croatia to private equity firm Carlyle for up to $945m.

Rigas said the deal was on track to complete by or just after the 2024 year end, "supporting our focus on core assets, deleveraging and delivering incremental shareholder returns".