Energean to sell Med portfolio to Carlyle for up to $945m

Private equity group to set up new E&P company to hold assets

Carlyle Group Inc.

€48.24

12:49 30/12/24

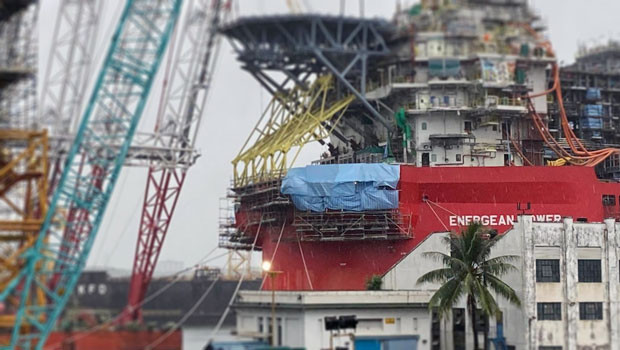

Energean said it had signed a deal to sell its portfolio in Egypt, Italy and Croatia to Carlyle Group for an enterprise value of up to $945m, with the private equity firm setting up a separate company to be chaired by former BP Chief Executive Tony Hayward.

Energean

1,028.00p

09:10 31/12/24

FTSE 250

20,449.41

09:10 31/12/24

FTSE 350

4,486.23

09:10 31/12/24

FTSE All-Share

4,443.79

09:10 31/12/24

Oil & Gas Producers

7,857.55

09:09 31/12/24

The gas explorer and producer said it planned to use the cash to repay a $450m corporate bond and pay out a $200m special dividend.

“This sale enables Energean to rationalise the portfolio and focus on its gas-weighted, gas-development strategy, underpinned by the Karish Field in Israel and recent farm-in to the Anchois field in Morocco,” the company said on Thursday.

Carlyle International Energy Partners, the fund's non-US energy investment arm, said it would set up the new company to look for more acquisitions in the Mediterranean. It will also hold recently acquired assets from Neptune Energy, Assala Energy and SierraCol.

The assets being acquired produce 47,000 barrels of oil equivalent a day. Energean originally bought them through its acquisition of Edison's oil and gas portfolio in 2020.

Reporting by Frank Prenesti for Sharecast.com