GCP Infrastructure reports flat NAV in first quarter

GCP Infrastructure Investments Ltd

69.90p

16:55 20/12/24

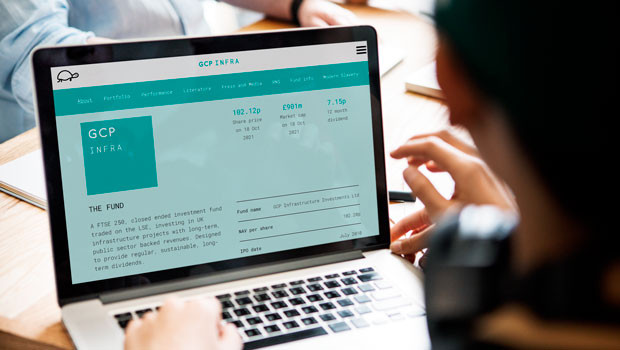

Closed-ended infrastructure investment company GCP Infrastructure reported on Monday that its portfolio value was more or less unchanged over its fiscal first quarter.

Equity Investment Instruments

12,067.95

17:14 20/12/24

FTSE 250

20,450.69

17:14 20/12/24

FTSE 350

4,463.29

17:14 20/12/24

FTSE All-Share

4,421.11

17:04 20/12/24

Net asset value per share was 109.84p by 31 December, up just 0.05p since the end of the last financial year on 30 September.

GCP said that the updated Office for Budget Responsibility inflation forecast after the government's Autumn Statement in November increased NAV/share by 1p, but this was partially offset by "further reductions in forecast electricity prices, primarily decreases in short-term power prices, decreasing forecast cash distributions to the company from certain renewable energy investments".

The company declared a 1.75p-per-share dividend for the first quarter, in line with its strategy to pay out dividends amounting to 7p over the year.

"Notwithstanding the lower electricity price forecasts, the portfolio continues to perform materially in line with the company's expectations," GCP said in an outlook statement.

"The company's mature, diverse and operational portfolio provides defensive access to income against a backdrop of market volatility and uncertainty."