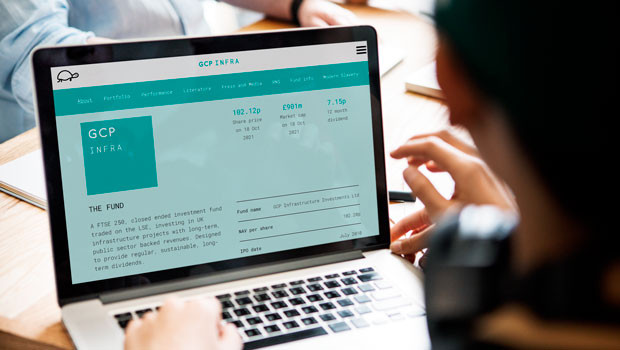

GCP Infrastructure posts dip in net asset value

GCP Infrastructure Investments posted a dip in net asset value on Monday, but said its portfolio continued to perform in line with expectations.

Equity Investment Instruments

12,191.67

12:54 24/12/24

FTSE 250

20,571.51

13:00 24/12/24

FTSE 350

4,491.87

12:54 24/12/24

FTSE All-Share

4,449.61

13:14 24/12/24

GCP Infrastructure Investments Ltd

70.70p

12:35 24/12/24

The closed-end investment firm, which focuses on infrastructure projects with long-term, public sector-backed, availability-based revenues, said NAV per ordinary share was 109.79p as at 30 September. That compares to 110.02p as at 30 June.

GCP Infra said that a period of very low winds and "exceptionally" dry weather in England and Scotland had decreased cash distributions from its renewables investment portfolio, which negatively contributed around 1.2p per ordinary share to the movement.

It continued: "Further reductions in electricity prices continue to decrease actual and forecast cash distributions to the company…driven by decreases in short-term power prices as a result of lower European gas demand, an ample supply of LNG, unseasonably mild weather and significant reductions in UK carbon prices, leading to wider price discounts between the UK emissions trading scheme and equivalent EU scheme."

However, it continued: "Notwithstanding the lower electricity price forecasts, the portfolio continues to perform materially in line with the company’s expectations.

"The company’s mature, diverse and operational portfolio provides defensive access to income against a backdrop of market volatility and uncertainty."

GCP Infra is advised by Gravis Capital Management.