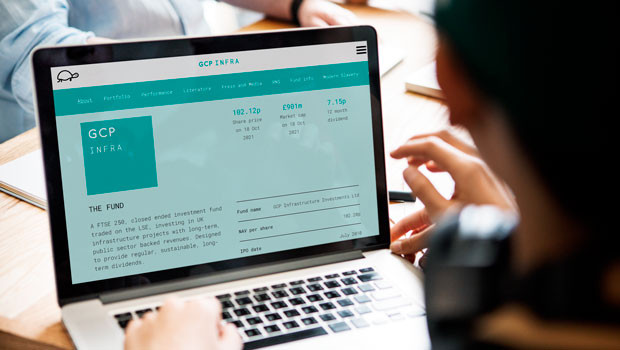

GCP Infrastructure upbeat on first-half performance

GCP Infrastructure Investments Ltd

69.90p

13:44 23/12/24

GCP Infrastructure Investments reported a strong first-half performance on Thursday, with a total shareholder return of 12.5%.

Equity Investment Instruments

12,073.14

13:44 23/12/24

FTSE 250

20,405.89

13:45 23/12/24

FTSE 350

4,467.00

13:45 23/12/24

FTSE All-Share

4,424.73

13:45 23/12/24

The FTSE 250 company said that during the six months ended 31 March, it paid dividends of 3.5p per share, consistent with the annual target of 7p per share.

Its total net asset value return for the period was 1.2%, and since its initial public offering, the total net asset value return stood at 172.8%.

The total shareholder return since the initial public offering had reached 76.7%.

GCP reported a profit of £9.9m for the period, down from £25.8m in the same period last year.

That decrease was put down to lower electricity prices and higher discount rates applied by the independent valuation agent.

No new loans were advanced during the period, although £12.3m was advanced to existing borrowers under contractual obligations.

Loan repayments amounted to £19.5m from renewable energy, and public-private partnership or private finance initiative projects.

The net asset value per ordinary share was 107.62p at the end of March, compared to 112.24p at the same time last year.

GCP#s independent valuation of its partially inflation-protected investment portfolio stood at £1bn, down slightly from £1.1bn in the prior year.

Since the period ended, GCP Infra sold its interest in loan notes secured against the Blackcraig Wind Farm at a 6.4% premium to its March valuation.

Additionally, the company made further advances of £0.2m and received repayments totaling £28.8m after the reporting period.

At 1218 BST, shares in GCP Infrastructure Investments were up 0.27% at 77.41p.

Reporting by Josh White for Sharecast.com.