Genuit maintains guidance despite lower HY profit

Genuit Group

384.50p

12:40 24/12/24

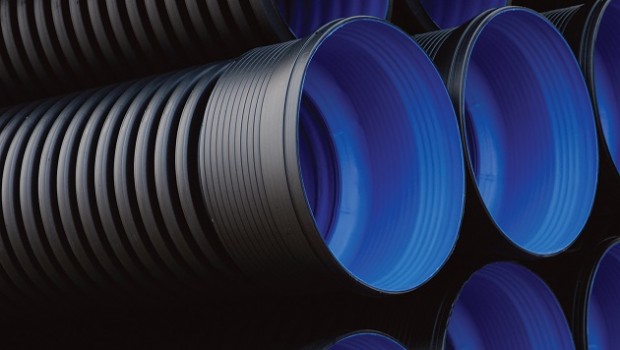

Pipe maker Genuit reported a fall in interim profits but maintained full-year guidance as revenues rose during the period due to a strong UK housing market.

Construction & Materials

12,142.66

12:54 24/12/24

FTSE 250

20,571.51

13:00 24/12/24

FTSE 350

4,491.87

12:54 24/12/24

FTSE All-Share

4,449.61

13:14 24/12/24

The company, formerly known as Polypipe, said pre-tax profit in the six months to June 30 fell 2.7% to £33m on revenues up 7.6% to £318m. The dividend was lifted 2.5% to 4.1p a share.

“Despite the short term headwinds in the residential sector - including ongoing boiler supply constraints- the long term fundamentals in this market continue to be strong, driven by new housebuilding and increased interest in energy efficiency,” Genuit said on Tuesday.

It added that “robust price leadership actions” and a greater focus on operational efficiency and cost base structure were expected to offset slightly weaker demand.

“Whilst mindful of the uncertain macroeconomic and geopolitical environment, our order books remain strong and the board anticipates the group will meet full year expectations.”

Genuit said inflation had been "a considerable challenge", along with supply constraints, most noticeably semiconductors and printed circuit boards, but the company noted signs that raw materials inflation was starting to ease.

It also reported said that it expected to make up lost sales in the second half after being hit by a cyber "incident" in the second quarter at its climate & ventilation division that resulted in temporary disruption to manufacturing and sales in April and May.

Reporting by Frank Prenesti at Sharecast.com