Hipgnosis delays interim results on valuation concerns

Company says songs may be worth more than recent deals in sector

Hipgnosis Songs Fund Ltd

102.00p

16:30 19/12/24

Music rights investor Hipgnosis Songs Fund has delayed publication of its interim results - which were due on Tuesday - as the board expressed concerns about the value of the company's assets following two sales at steep discounts.

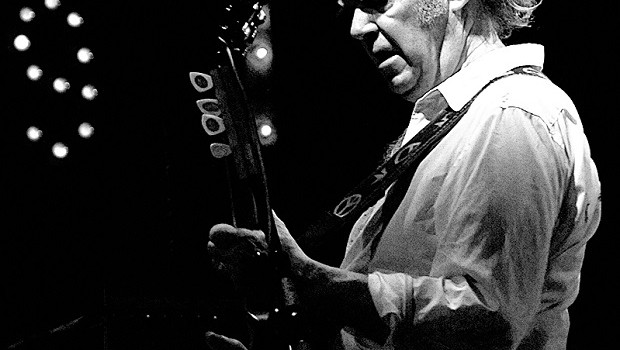

Hipgnosis, which owns song rights by artists such as Neil Young and Beyonce, said an independent valuation was "materially higher than the valuation implied by proposed and recent transactions in the sector".

It highlighted the failed sale of almost a fifth of its music catalogue to private equity investor Blackstone for $417.5m at a discount of 24.3% to the valuation at the end of March, and a deal last week that offloaded 20,000 songs "non-core" songs for $23.1m at a 14.2% discount as it sought to raise desperately needed cash.

The board said it sought advice on the independent valuation from its investment advisor Hipgnosis Song Management, which effectively decides on investments in the fund and is majority owned by Blackstone-operated funds.

"Hipgnosis Song Management Limited eventually provided an opinion, which was heavily caveated, such that the board has concerns as to the valuation of the company's assets in its interim results," Hipgnosis Songs Fund said.

"The company expects to publish the interim results by 31 December 2023."

Hipgnosis was founded in 2018 by former artist manager Merck Mercuriadis, who saw online streaming of music as a viable investment opportunity to garner royalty income from popular hits.

However, rising interest rates have seen investors turn to other asset classes and forced the company to change how it calculates the value of future revenues. Hipgnosis in October cancelled dividend payments to shareholders, saying that changes to US royalties had reduced its income and a payout would force it to breach its covenant with lenders.

Blackstone had previously invested in Hipgnosis Song Management. Shareholders in the Hipgnosis fund balked at offering such a big discount to a related party, and voted against the deal in late October.

"Hipgnosis Songs Fund has always been an unusual animal on the stock market. They own portfolios of songs, for which they collect the royalties. That idea’s simple enough, but what’s it worth? And that’s where it all gets a bit rum," said Steve Clayton, head of equity funds at Hargreaves Lansdown.

"In theory, if you know how often a song will be played on the radio, how often it is streamed and how often people purchase recordings of it or play it on stage, you can create a discounted cash flow model and a number will pop out."

"Today, however, the group have announced a delay to their interim results. The reason for this is that the numbers popping out of the valuation process are not what was expected."

Reporting by Frank Prenesti for Sharecast.com