Hipgnosis proposes £20m payment to entice bidders

Hipgnosis Songs Fund Limited NPV

101.80p

16:30 26/07/24

Troubled music rights owner Hipgnosis Songs Fund has asked shareholders to vote on a special resolution intended to help attract potential bidders.

FTSE 250

20,508.75

15:45 15/11/24

FTSE 350

4,453.56

15:45 15/11/24

FTSE All-Share

4,411.85

15:45 15/11/24

The board wants to amend the articles of the company to enshrine a payment of up to £20m to any prospective bidder.

It said on Thursday that the payment would act as a form of "cost protection" to any bidders who wanted to acquire the company's assets on terms recommendable to shareholders.

HSF’s investment advisor is Hipgnosis Song Management, which is run by Merck Mercuriadis, the fund’s founder. Hipgnosis Song Management has a call option that gives it the right to purchase HSF’s portfolio if its agreement with the fund is terminated, which the board argued could deter bidders.

Robert Naylor, who took over as chair of HSF in November, said: "From our shareholder consultations, core to the requirement for change is addressing the call option held by our investment advisor, Hipgnosis Song Management.

"This not only acts as a structural conflict between the interests of our shareholders and the investment advisor, but also creates a significant deterrent to potential bidders for the company’s assets, thereby depressing the value of the company."

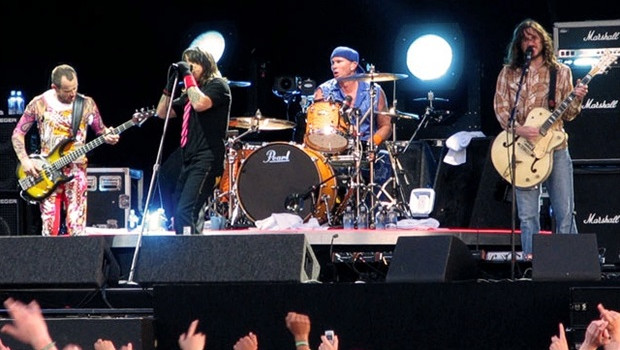

The proposal is the latest development in a turbulent period for the troubled firm, which owns the rights to work by artists such as the Red Hot Chili Peppers, Blondie and Neil Young.

In October, investors voted overwhelmingly against HSF continuing as a closed-ended investment company. They also voted against the proposed sale of 29 music catalogues to a partnership between Hipgnosis Songs Management and Blackstone in $440m deal.

Said Naylor: "Investors in HSF overwhelmingly voted for change when they rejected the continuation of the company and proposed sale of certain music assets."

The board noted that investors holding an aggregate stake of around 35% had already indicated their support for the proposal. Shareholders will vote on the proposal at an extraordinary general meeting.

Mercuriadis, a former band manager, founded HSF in 2018.