ITM Power improves guidance after solid first half

ITM Power

36.20p

12:40 24/12/24

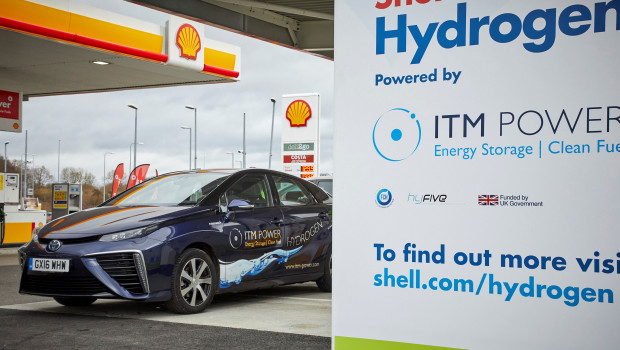

Shares in ITM Power surged on Wednesday after the energy storage and clean fuel company impressed with its interim results and improved its full-year guidance.

Alternative Energy

0.00

15:10 16/09/24

FTSE AIM 100

3,464.93

13:14 24/12/24

FTSE AIM 50

3,897.43

13:14 24/12/24

FTSE AIM All-Share

717.40

13:14 24/12/24

ITM said that its performance over the six months to 31 October brings it "one step closer to becoming a profitable company in the future".

Revenues jumped to £8.9m, from £2.0m the year before, driven mainly by product and service revenue from cube deliveries to Germany, and a number of units of NEPTUNE, ITM's fully autonomous, plug and play electrolyser system.

The result was also ahead of the £7.5m guided to in a trading update last month after the company concluded a commercial discussion with a customer earlier than expected.

Meanwhile the adjusted EBITDA loss shrunk to £21.0m from £54.1m.

ITM also announced it has successfully completed its 12-month restructuring plan which has "made ITM a stronger, more focussed, and more capable company".

The plan was based on the following three targets: narrowing the product portfolio for standardisation and volume manufacturing; having greater capital discipline, cost reduction, and improved processes; and "debottlenecking" manufacturing and testing, and increasing automation.

"I am pleased to report that we have completed the implementation of our 12-month plan on time. The first half of the financial year already paints the early picture of a new ITM, which starts to be reflected in our improved financial results," said chief executive Dennis Schulz.

Looking ahead, ITM held on to its full-year revenue guidance of £10-18m, but has positively narrowed its adjusted EBITDA loss forecasts to £45-50m, from £45-55m previously, while net cash at year end is expected to be in the range of £200-220m, up from an earlier target of £175-200m.

The stock was up nearly 11% at 53.05p by 0854 GMT.