ITM Power narrows interim losses, lifts FY cash guidance

ITM Power

35.42p

17:10 19/02/25

Shares in ITM Power sparked on Thursday as it posted a narrowing of its interim losses and lifted cash guidance for the year.

Alternative Energy

0.00

15:10 16/09/24

FTSE AIM 100

3,463.57

17:14 19/02/25

FTSE AIM 50

3,853.64

17:14 19/02/25

FTSE AIM All-Share

719.43

17:14 19/02/25

In an update for the six months to the end of October 2024, the energy storage and clean fuel company said adjusted EBITDA losses narrowed to £16.8m from £18.1m in the same period a year earlier.

Revenue rose to £15.5m from £8.9m, driven mainly by product revenue from NEPTUNE deployments.

ITM hailed a record contract backlog to date of £135.3m, up from £43.7m two years ago.

The company reiterated its guidance for full-year revenue of £18m to £22m and adjusted EBITDA losses of between £32m and £36m. It also lifted its cash guidance to between £185m and £195m, from £170m to £180m.

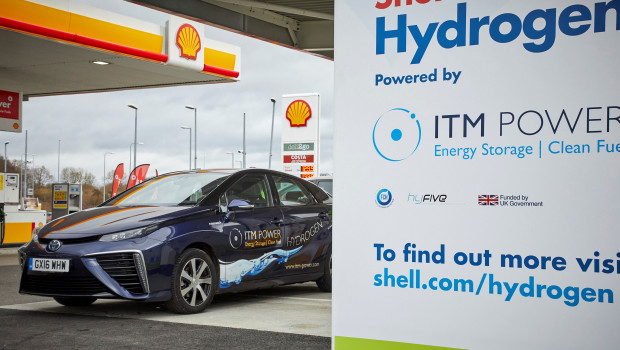

Chief executive Dennis Schulz said: "Our sales pipeline and contract backlog have never been healthier, and we now have a product portfolio tailored to our customers' needs. This has been evidenced in us winning the Shell REFHYNE II 100MW project, two contracts for a total of four NEPTUNE V units, and a 50MW and a 10MW FEED contract; all profitable orders.

"Operationally, we are in the best condition the company has ever been in. Tangible evidence of this is our continuously improved factory acceptance test (FAT) first-time-pass rate for stacks, which now stands at 98%, up from below 50% just two years ago."

At 1055 GMT, the shares were up 12% at 39.16p.