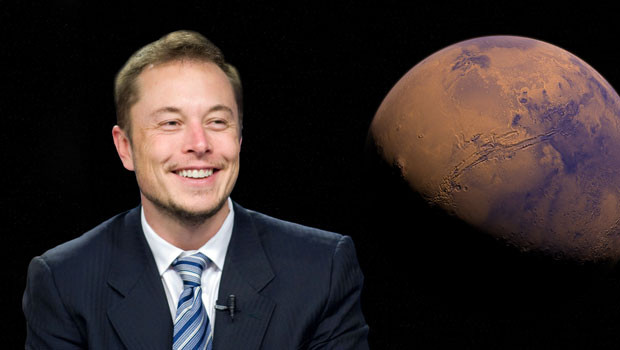

Musk pledges more equity funding for Twitter takeover

Elon Musk has pledged further equity funding for his $44bn offer for Twitter, after letting a $6.25bn margin loan commitment lapse.

Nasdaq 100

21,797.65

09:15 24/12/24

Tesla Motors Inc

$462.28

12:00 24/12/24

Twitter Inc

$53.70

11:00 18/12/24

The Tesla and SpaceX billionaire had originally lined up a number of Wall Street lenders to help finance the takeover, by providing loans secured against his stake in the electric car manufacturer.

The initial margin loan was for $12.5bn, later reduced to $6.25bn after Musk brought in more investors, including Oracle founder Larry Ellison and cryptocurrency exchange Binance.

But is has now been allowed to lapse completely, according to a regulatory filing made on Wednesday. Instead, Musk has pledged an additional $6.25bn, taking his personal contribution to the funding up to $33.5bn.

Musk is also in talks with shareholders, including co-founder Jack Dorsey, about rolling over their stakes, thereby reducing the amount of cash needed to fund the takeover. Dorsey, the platform’s former chief executive up until last year, stepped down from the board of directors on Wednesday as planned.

Dorsey has publicly supported Musk’s takeover offer, which was accepted in late April, tweeting: "This is the right path…I believe it with all my heart."

Musk, who wavered his right to carry out due diligence, earlier this month said the deal was "on hold", after disputing the number of fake accounts on the platform. Twitter estimates it is around 5% but Musk believes it could be closer to 20% and suggested the price should be lowered as a result.

However, Musk faces a $1bn break fee if he tries to pull out of the deal, and could face legal action. Twitter has also made it clear that it expects the deal to complete at the agreed price of $54.20 per share.

Shares in Twitter remain well below the asking price, closing on Wednesday night at $37.16. As at 1130 BST, the stock was ahead 6% in pre-market trading. Shares in Tesla were flat.