PayPoint on track after solid Q2

PayPoint said it's confident of meeting expectations this year after a solid second quarter for the payments and merchant services group.

FTSE All-Share

4,467.80

13:14 31/12/24

FTSE Small Cap

6,844.04

12:59 31/12/24

PayPoint

780.00p

12:40 31/12/24

Support Services

10,552.52

12:59 31/12/24

The company said it has seen "positive progress across the group with strong momentum and operational delivery across all divisions".

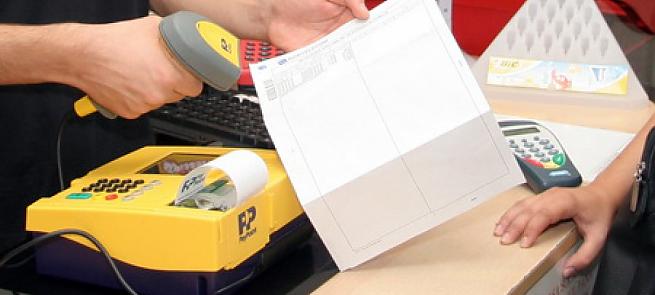

In its Shopping division, PayPoint noted a strong sales performance with further site growth in the PayPoint One retailer partner estate and in the Handepay EVO card processing estate.

E-commerce operations saw "excellent" volume growth, where it supports carriers through its tech and logistics platform Collect+, which surpassed the 2m weekly parcel level in August.

In Payments & Banking, two further Neo Bank clients will go live in September, PayPoint said, while it continues to see new business opportunities across the housing, local authority and charity sectors for its payments platform, MultiPay.

Meanwhile, the Love2shop unit has seen strong early uptake of the PayPoint Park Super Agent offering, with over 500 retailers already signed up ready to recruit savers for the Christmas 2024 season.

In separate news, PayPoint announced that Rob Harding, former chief financial officer at banknote printer De La Rue, would be replacing current finance director Alan Dale who is due to retire at the end of the year.

The stock was up 1.5% at 550.02p by 1424.