Sunday newspaper round-up: Middle East, Aston Martin, Defence

Britons must accept that their country was now involved in the Middle East conflict, Tobias Ellwood said. The former defence minister warned that "nobody was in full control" of the growing conflict as more and more countries were sucked in. Ellwood also said that Tehran's strike had taken the conflict into a "new dangerous territory". - Sunday Telegraph

Aerospace and Defence

13,190.70

10:20 19/02/25

Airbus Group N.V.

€173.30

18:16 18/02/25

Aston Martin Lagonda Global Holdings (Ass Ptl Cash)

0.00p

17:19 10/09/19

Babcock International Group

648.00p

10:19 19/02/25

Food & Drug Retailers

4,413.42

10:20 19/02/25

FTSE 250

20,803.03

10:20 19/02/25

FTSE 350

4,793.55

10:20 19/02/25

FTSE All-Share

4,742.27

10:20 19/02/25

Morrison (Wm) Supermarkets

286.40p

16:55 26/10/21

Aston Martin chief executive officer Amedeo Felisa has come under criticism after news that he was given £1.3m to cover his expenses for the weekly commute form Italy to the Midlands on a private jet. The row follows a major revolt among AstraZeneca shareholders over the proposed pay package for its boss. Sky-high pay packages are also expected to trigger a rebellion among shareholders at Smith & Nephew and LSE Group. - The Financial Mail on Sunday

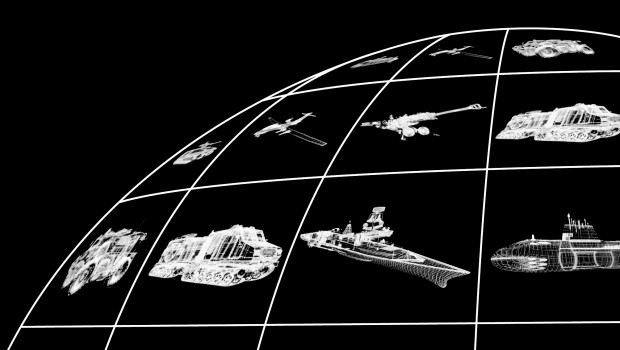

Top defence chiefs, including the heads of Airbus and Babcock, are calling for the UK to invest more in defence due to the heightened risk of conflict across the world. The UK and other countries need to take such threats seriously and respond appropriately, Airbus head of space and defence Ben Bridge said. Babcock chief David Lockwood also called for greater spending on defence, saying now was the first time that we were not taking Western freedoms for granted. - The Sunday Telegraph

Grocers are selling and then leasing back their stores in order to free up cash with which to lower their debt piles. Asda and Morrisons led the way in 2023 with transactions to sell their stores and warehouses. Indeed, such deals made up nearly half of all property deals last during the previous year, versus just 1% in 2022. - Financial Mail on Sunday