EXANTE Broker Review: Brokerage Features, Fees, and More

Founded in 2011, EXANTE is a trading platform with direct access to financial markets and more than one million financial instruments. Licensed by the FCA (UK), MFSA (Malta), CySEC (Cyprus) and SFC (Hong Kong), EXANTE’s multi-asset trading platform serves investors in more than 100 countries and is ideal for seasoned investors who are looking to trade across multiple asset classes.

Pros & Cons

Pros

Trade more than one million financial instruments with a single account

Trading instruments include stocks, ETFs, bonds, and more

A robust trading platform available on web, mobile, and desktop

EXANTE is licensed with multiple bodies, including FCA (UK) and MFSA (Malta)

A transparent fee structure with competitive rates.

Cons

High minimum deposit requirements may deter smaller investors.

Limited customizability with no option for third-party indicators on the terminal.

Withdrawal fee of €30, regardless of the amount.

Fees

When it comes to the platform’s pricing, EXANTE has a transparent fee structure, and commissions are charged solely for executed trades. This includes clearing and exchange fees, as well as the cost of execution. There are no application or usage fees, which is an attractive feature for active traders as many other brokers charge additional platform fees.

There are no management fees and no account maintenance fees. EXANTE also doesn’t charge margin-trading fees; you can trade with leverage as long as you keep the margin utilization below 100%.

For traders dealing in stocks and ETFs, rates start from a competitive 0.02 USD per share, positioning EXANTE as an attractive option for those trading on major US exchanges. For European exchanges, fees range between 0.02% to 0.18%, depending on the specific market.

The EXANTE platform offers spreads starting from 0.2 pips on popular currency pairs, and leverage is provided for liquid stocks, fixed-income currencies, and bonds.

Note that the overnight fee is not fixed and will be charged on FX and short positions. Rollover fees are calculated daily at 4 PM GMT for the previous night, which traders need to account for in their strategies.

While there are no minimum transactions required, a flat withdrawal fee of €30 is applied regardless of the withdrawal amount, making it less economical to make smaller withdrawals.

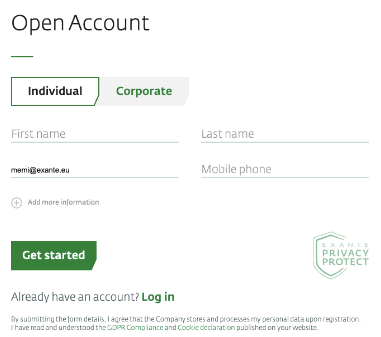

Account Opening

Opening an account with EXANTE is easy, with a streamlined process that upholds a high standard of due diligence to comply with regulatory requirements.

Opening an account with EXANTE is easy and secure, with a demo account option available.

There is a minimum deposit of €10,000, which may be a barrier for entry-level investors but aligns with the platform's target audience of serious traders and institutions.

To register with EXANTE, prospective clients must provide a copy of their passport and proof of residence, such as a utility bill or bank statement. These documents can be easily uploaded, and the verification process typically takes less than 24 hours, provided the documents are clear and valid. Once verified, clients can deposit the minimum required amount to activate their brokerage account.

EXANTE also offers a demo account, which mirrors a live trading environment. This is a great option for new users to get familiar with the platform and its functions, without risking their own capital. The demo account comes with a virtual balance of €1,000,000.

Another benefit of using the demo account feature is that EXANTE offers real-time quotes on the most popular US stocks - this is a rare feature another other professional brokerages.

Deposit and Withdrawal

Although EXANTE focuses on high-net-worth individuals and institutions, deposits and withdrawals are easy to navigate. Clients can fund their accounts via wire transfer, and EXANTE supports deposits in a range of currencies, including euros, US dollars, and British pounds, catering to a global clientele.

The initial deposit requirement reflects the broker's target market, with the minimum requirement for individual traders being €10,000. Corporate accounts require a minimum of €50,000. There is no maximum limit set for deposits.

When it comes to withdrawals, clients can request funds to be transferred back to their bank accounts through the EXANTE client area. The process is designed to be user-friendly and secure, incorporating two-factor authentication to verify the identity of the requester.

EXANTE has a flat withdrawal fee of €30, with no minimum withdrawal amount required. However, clients should be aware of potential fees charged by their banks.

The high minimum deposit requirement and the flat withdrawal fee may not be ideal for small investors, but it highlights EXANTE’s commitment to its sophisticated trading audience.

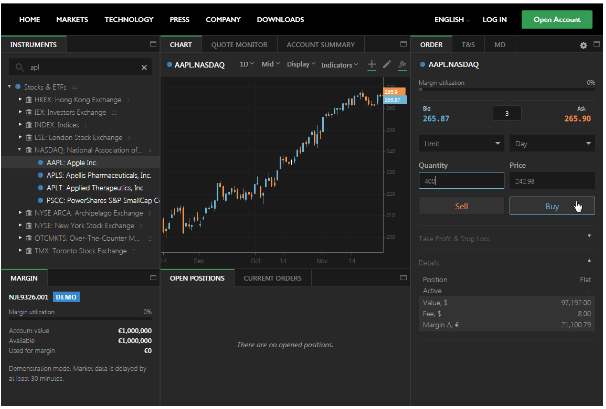

EXANTE's Web Trading Platform

EXANTE's web-based trading platform showcases its commitment to a smooth and hassle-free trading experience for its clients. Clients can access the platform from any web browser, without the need to download any software.

The web platform has a sleek and intuitive user interface, offering a balance between sophistication and simplicity. Traders can easy to between all the financial instruments, execute trades, and manage their portfolios. The platform's real-time data feeds and charting tools are comprehensive, giving traders the resources they need to make informed trading decisions.

One of the key features of the web trading platform is customization, allowing traders to personalize their workspace to suit their trading styles.

Traders can arrange charts, quotes, and news feeds according to their preferences so that they have the most relevant information available. It’s worth mentioning that the platform doesn’t currently support the addition of new custom or third-party indicators, which may be a limitation for some technical traders.

The platform has rigorous security features built-in, with data encryption and secure login procedures ensuring the protection of clients’s data and transactions.

EXANTE’s web trading platform is a convenient and reliable tool, designed to meet the needs of most traders. While it may lack certain customization options, its robust security measures and user-friendly design make it a good choice for investors who prefer a web-based platform.

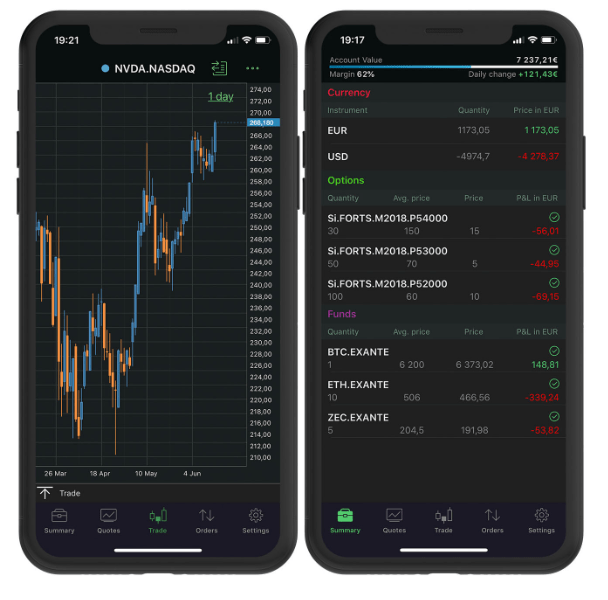

EXANTE's Mobile Trading Platform

Modern traders want the ability to trade on the go, which is where EXANTE’s mobile trading platform comes in. The app is available for both iOS and Android devices, so traders can stay connected to the markets, no matter where they are.

EXANTE’s mobile platform is available for iOS and Android devices.

Features and Usability

The mobile platform has some similar features to the desktop version, with a comprehensive suite of trading tools with a sleek and user-friendly interface.

Traders can access real-time market data, manage their portfolios, and execute trades with just a few taps. With an intuitive design and a clear layout, the app is very easy to navigate.

EXANTE’s platform also features an option desk, bond screener, and a basket trader. The Multi-Account Manager (MAM) module allows you to allocate deals to an unlimited number of accounts, in a single click.

Functionality and Performance

Despite being a mobile version, EXANTE’s trading app does not fall short on performance. It has robust charting capabilities, with a variety of time frames and technical indicators available to traders.

The app also includes a secure wallet feature, allowing for quick and easy management of funds. Traders can set up price alerts, enabling them to quickly react to market movements.

Security and Accessibility

Security is extremely important for any mobile trader which is why EXANTE's mobile app has strict security measures in place to protect user data and transactions. It uses two-factor authentication and automatic logouts to protect sensitive information on mobile devices.

Limitations

The mobile platform does have its limitations. There’s a limited selection of technical indicators for chart analysis, which may not be enough for advanced traders.

EXANTE's mobile trading platform stands out for its ease of use, comprehensive features, and robust security. While there is room for enhancement, particularly in terms of technical indicators, the app provides a solid trading experience for traders who need to stay connected to the markets on the move.

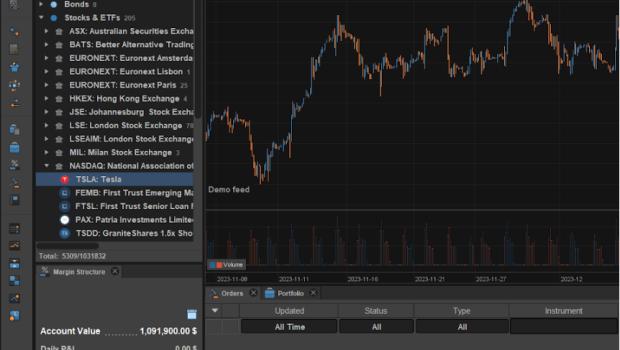

Desktop Trading Platform

For traders who prefer the full-fledged experience of a desktop application, EXANTE's desktop trading platform is a powerhouse of trading tools and features. Designed to cater to the needs of professional traders, the desktop platform combines efficiency with depth, offering a rich trading environment.

One main benefit of using the desktop trading platform is that it doesn’t rely on your browser and http protocol, thus trading orders are processed much faster and they are less subject to delays and connectivity issues.

Advanced Charting and Analysis Tools

EXANTE’s desktop trading platform has advanced trading tools and features

The desktop platform has advanced charting capabilities and an extensive range of technical indicators. Traders can analyze market trends and patterns with precision, and customize charts to their preference.

The desktop platform has multiple chart types and time frames, which support various trading styles and strategies.

Customization and Flexibility

One of the standout features of the desktop platform is its customization abilities. Traders can change the workspace to fit their needs, arranging modules and windows to optimize their trading workflow.

The ability to create and save multiple workspace layouts is particularly useful for traders who operate across different markets or use diverse strategies. The platform has a quick search function, drag-and-drop features, and a wide range of charting tools.

EXANTE’s platform works on every device - web, desktop, and mobile. With a multi-currency account and multilingual interface, you can trade anywhere you want.

EXANTE focuses a lot on customisation - more than you typically see with similar brokers - and flexibility is definitely something that traders are looking for.

APIs for Automated Trading

EXANTE offers APIs for automated trading. Their HTTP API enables the design fast, data-rich financial apps, while their FIX API supports full FIX Protocol ver. 4.4 — a de-facto industry standard for securities transactions and markets. The latter is ideal for low latency connections and complex setups.

Security and Reliability

As with all of EXANTE's platforms, security is a top priority here. The desktop version has advanced encryption protocols and secure login processes to safeguard user data and transactions.

The platform also focuses on reliability, with minimal downtime and rapid execution speeds.

Limitations

Despite its many strengths, the desktop platform does not currently support the addition of new custom or third-party indicators, which may limit its appeal to some technical traders. Its extensive list of features comes with a steep learning curve, which may be challenging for less experienced traders.

While the platform may present some limitations in terms of indicator flexibility, its overall performance and reliability more than compensate for these shortcomings.

Markets and Products

EXANTE's expansive reach across global financial markets is one of it’s best features - offering traders access to more than one million financial instruments. EXANTE is a trusted broker that enables advanced traders to diversify their portfolios.

Extensive Range of Financial Instruments

EXANTE offers access to an impressive range of financial instruments, including:

Stocks and ETFs: With access to over 30,000 stocks across global exchanges, traders can engage in equity markets with ease. The availability of ETFs adds another layer of diversification, allowing for broader market exposure.

Currencies and precious metals: Traders can participate in the forex market with more than 50 currency pairs, including majors, minors, and exotics. Metals trading is available, offering a traditional hedge against market volatility.

Bonds: A selection of government and corporate bonds provides opportunities for fixed-income investments.

Futures: With 500 types of futures contracts, traders can speculate on the future price movements of various commodities and financial instruments.

Options: The platform offers hundreds of thousands of options, providing strategies for risk management or speculation.

Global Market Access

EXANTE offers access to more than 50 financial markets, including major financial hubs like the New York Stock Exchange, NASDAQ, the London Stock Exchange, and the Tokyo Stock Exchange. Traders have access to more than 30,000 stocks from around the world.

The ability to trade across these diverse markets from a single multi-currency account is not only convenient but also cost-effective, as it eliminates the need for multiple brokerage accounts and the associated fees.

Research

When it comes to investing, informed decision-making is very important, and EXANTE equips its clients with a suite of research tools and resources to ensure they can trade with confidence.

Cutting-Edge Analytical Tools

EXANTE's platform comes integrated with advanced analytical tools that enable traders to perform in-depth market analysis. These include:

Advanced charting: A comprehensive array of charting tools, complete with a range of time frames and technical indicators, assists traders in identifying trends and crafting their strategies.

Customizable watchlists: Traders can closely monitor their preferred instruments by creating personalized watchlists.

Expert Insights and Market Analysis

Beyond the tools, EXANTE provides its clients with expert insights and market analysis. This content is curated to give traders a broader perspective on market dynamics and potential investment opportunities.

These include:

Market analysis: Regular reports and analysis from financial experts offer a deep dive into market trends and outlooks.

Guides and videos: Onboarding guides, explainer videos and a dedicated YouTube channel to support new users and help traders make the most out of their trading experience.

Access to Historical Data

For those who rely on historical data to inform their trading decisions, EXANTE provides an extensive archive of past market data. This historical data is crucial for backtesting trading strategies and understanding long-term market trends.

By combining real-time market access with robust research tools and expert insights, EXANTE ensures that its clients are well-equipped to navigate the complexities of the financial markets.

Customer Service

EXANTE is dedicated to superior customer service and understands the importance of fast response times. Their multi-lingual customer service team is available 24 hours a day, seven days a week, ensuring that clients can receive assistance whenever the markets are open.

Support Channels

Clients can reach out to EXANTE's customer service through various channels:

Phone: Direct lines are available for immediate and personalized support

Email: For less urgent or more detailed inquiries, clients can send an email to the support team

Live chat: The live chat feature on EXANTE's website and trading platforms offers real-time assistance for quick responses to trading issues

Quality Customer Care

EXANTE's customer service representatives are not only accessible but also highly knowledgeable. With a deep understanding of the platform and the financial markets, they can provide insightful support.

As a leading broker, EXANTE is committed to quick response times, with most issues being addressed within a matter of hours.

Personal Account Managers

EXANTE assigns personal account managers to clients. These managers serve as a single point of contact for all account-related queries, providing a consistent and personalized service experience.

Feedback and Continuous Improvement

EXANTE values client feedback and uses it to continuously improve its service offerings. Whether it's a suggestion for a new feature or feedback on an existing service, EXANTE values client input and strives to adapt and enhance its services accordingly.

Customer Resources

In addition to reliable customer support, EXANTE offers traders a number of tools to help them make the most of their trading experience. This includes onboarding guides for new users, as well as explainer videos to help traders understand the platform and the features available.

EXANTE also has a YouTube channel for users to learn more about the markets, trading strategies, and the company itself.

Demo Account for Practical Learning

Complementing the theoretical resources, EXANTE's demo account serves as a practical learning tool.

Sign up for an EXANTE demo account to get familiar with the trading environment.

Clients can practice trading with virtual funds, allowing them to apply what they've learned in a risk-free environment. This hands-on approach helps reinforce learning and builds confidence.

Safety

When considering an online brokerage, traders need to focus on the safety of their funds and personal data. EXANTE takes security very seriously and implements multiple financial and information safety measures.

Regulatory Compliance

EXANTE is regulated by several authoritative bodies, including the FCA (UK), MFSA (Malta), CySEC (Cyprus), and SFC (Hong Kong), and complies with the Markets in Financial Instruments Directive (MiFID). These regulations ensure that EXANTE operates within strict financial and ethical standards, providing traders with peace of mind regarding the safety of their investments.

Investor Protection

Funds deposited with EXANTE are protected under the Investor Compensation Scheme, which serves as a safety net in the unlikely event of the broker's insolvency.

This scheme is designed to compensate clients for a portion of their assets, safeguarding their investments against unforeseen financial difficulties faced by the brokerage.

Secure Infrastructure

EXANTE's trading platforms are fortified with industry-standard encryption protocols like 2FA, ensuring that all data transmissions are secure. The broker employs robust firewalls and secure server facilities to protect against unauthorized access and potential cyber threats.

Data Privacy

Adhering to stringent data protection laws, EXANTE is committed to maintaining the confidentiality of client information. EXANTE's privacy policy outlines the measures taken to prevent the misuse of personal data, ensuring that client privacy is respected at all times.

EXANTE is GDPR (Guide to General Data Protection Regulation) compliant, ensuring the confidentiality of personal data.

Two-Factor Authentication

To enhance account security, EXANTE implements two-factor authentication (2FA) across its platforms. This additional layer of security requires clients to verify their identity through a second method, such as a mobile app or SMS code, making unauthorized account access significantly more difficult.

Why Choose EXANTE As Your Trading Platform

With its sophisticated web, mobile, and desktop platforms, EXANTE provides access to an impressive range of financial instruments, along with a regulatory framework that instills trust, and a fee structure that rewards active trading.

Here’s why EXANTE is a top choice when it comes to choosing a broker:

EXANTE's high minimum deposit aligns with its target demographic of seasoned investors and institutions

The transparent fee structure is competitive, but traders should consider the overnight charges and fixed withdrawal fee

The streamlined account opening process, along with a demo account feature, emphasizes EXANTE's commitment to security and professionalism

EXANTE has a multi-lingual customer service team that is available 24/7, and a wealth of educational resources for their customers

Final Thoughts

With the financial landscape continuously evolving, EXANTE is the ideal trading platform for seasoned investors and those looking for direct acess to financial markets.

EXANTE’s proprietary trading platform offers access to more than one million financial instruments, including stocks, ETFs, bonds, futures, and more from a single, multi-currency account.

FAQs

What is the minimum deposit to open an account with EXANTE?

EXANTE requires a minimum deposit of €10,000 to open a brokerage account. This is because the platform is aimed at serious traders who are committed to investing in the financial markets.

How does EXANTE ensure the security of my investments?

EXANTE takes the security of your investments very seriously. It is regulated by multiple financial authorities, including the MFSA and CySEC, and adheres to the MiFID II Directive. Client funds are protected under the Investor Compensation Scheme and are held in segregated accounts, separate from the company's funds. The trading platforms employ industry-standard encryption protocols to secure your personal and financial data.

What trading platforms does EXANTE offer?

EXANTE provides a range of trading platforms to suit different trader preferences, including web, mobile, and desktop versions. Each platform is designed with a user-friendly interface, advanced trading tools, and robust security features. However, the platforms do not currently support third-party indicators, which may be a limitation for some traders.

How can I deposit funds into my EXANTE account?

Funds can be deposited into your EXANTE account via wire transfer. The broker accepts transfers in various currencies, catering to a global client base. While there is no maximum deposit limit, the minimum deposit requirement is €10,000 for individual traders and €50,000 for corporate accounts.

What are the withdrawal fees and procedures at EXANTE?

EXANTE charges a flat withdrawal fee of €30, regardless of the withdrawal amount. Clients can initiate a withdrawal through the EXANTE client area, and the process includes two-factor authentication for added security. While there is no minimum withdrawal amount, clients should be aware of potential additional fees charged by their banks.

What research tools does EXANTE provide?

EXANTE equips traders with a suite of research tools, including real-time data feeds, advanced charting, and customizable watchlists. They also offer expert insights, market analysis, and resources such as onboarding guides and explainer videos to help traders make informed decisions.

How does EXANTE support its clients?

EXANTE's customer service team is available 24/7 through phone, email, and live chat. The broker provides personal account managers to offer tailored assistance and values client feedback to continuously improve its services. Additionally, a comprehensive range of educational materials is available to support clients in enhancing their trading knowledge and skills.

What educational resources are available at EXANTE?

EXANTE offers an extensive collection of educational resources, including webinars, video tutorials, and articles. These materials cover a wide range of topics suitable for both beginner and experienced traders. The broker also provides a demo account for practical learning and regularly updates its educational content to reflect the latest market conditions.

Is EXANTE suitable for beginner traders?

While EXANTE's services are designed with professional traders and institutions in mind, the broker does provide educational resources and a demo account that can benefit beginners. However, the high minimum deposit requirement and the sophisticated nature of the trading platforms may be more suited to traders with some experience in the financial markets.