Full List Of Stories

Bids value BHP's US shale assets at $9bn

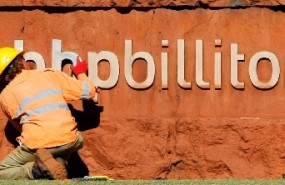

Multinational mining, metals and petroleum firm BHP Billiton has received the first round of bids for its US shale portfolio, valuing the unit at between $7bn and $9bn, according to sources who spoke to Bloomberg.

Powerhouse Energy discredits reports of Chester planning rejection

UK technology firm Powerhouse Energy on Wednesday has branded reports that University of Chester’s Thornton Science Park faces closure by Cheshire West and Chester Council as "inaccurate".

CH Bailey subsidiary leases property to Maltese government

Property group CH Bailey announced on Wednesday that one of its subsidiary companies in Malta has entered into a lease agreement with an agency of the government of Malta for a company property.

Findel swings to profit thanks to Express Gifts performance

Home shopping and education supplies group Findel PLC announced on Wednesday that it swung to a profit in the 12 months leading up to 30 March, after a strong showing from its Express Gifts business.

World Cup 2018: which companies will be the big winners?

As FIFA's month-long World Cup football extravaganza draws tantalisingly close, analysts have highlighted sectors that should score stronger profits, including airlines, sports retailers and bookmakers.

Sterling Energy appoints former DEO Petroleum boss as chief executive

Oil and gas exploration firm Sterling Energy announced on Wednesday that David Marshall has been appointed chief executive with immediate effect.

Papua Mining lands experienced non-executive director

Papua Mining announced on Wednesday that it has added "measurable corporate strength" after appointing Gordon Hart as non-executive director of the company, effective immediately.

Sirius Real Estate disposes of loss-making asset for €3.8m

Business park operator Sirius Real Estate sold off its Bremen Hag business park in Germany for €3. 8m, in line with the property’s book value.

Instem wins contract with Fortune 500 player

Life science IT solutions provider Instem boasted on Wednesday that a large Fortune 500 pharmaceuticals company has adopted its Samarind RMS software-as-a-service (SaaS) solution in a contract worth approximately $0. 75m.