Latest News

Euro area visible trade surplus widens in March

The euro area's visible trade surplus increased sharply in February, prompting a positive reaction from economists despite the sharp drop seen in the bloc's imports from the rest of the world.

Trump signs order for firms to 'Buy American, Hire American'

US President Donald Trump has signed an executive order which will lead to a review of a visa scheme for skilled foreign workers, encouraging US companies to "Buy American, Hire American. ".

Credit Suisse still positive on European stocks, ups view on UK

A mis-match between the performance of stocks from 'cyclical' geographical regions, such as Continental Europe, Emerging Markets and Japan versus cyclical sectors meant there was an opportunity to be had, strategists at Credit Suisse said as they reiterated their positive stance towards shares from the former two of those regions.

Tax Systems trades well after mid-year acquisition

Corporation tax software and services supplier Tax Systems announced its audited results for the year to 31 December 2016 on Wednesday - the year in which it acquired Tax Computer Systems on 26 July 2016 for an enterprise value of £73m.

Altitude surges on supply contract wins

Shares in Altitude surged over 30% after the technology service provider announced it had won two US supply agreements for an undisclosed sum.

US pre-open: Stocks seen flat ahead of more earnings; Morgan Stanley in focus

US futures pointed to a muted open on Wall Street on Wednesday as investors looked ahead to more earnings, with Morgan Stanley on the slate.

River and Mercantile looking positive after third quarter

Investment solutions business River and Mercantile Group updated the market on its for the three and nine months ended 31 March on Wednesday, with fee earning assets under management and notional under management increasing by 6% to £30. 6bn in the quarter through March.

System1 strong after rebrand and accounting date shift

System1 - the company formerly known as BrainJuicer - updated the market on its trading for the 12 months to 31 March on Wednesday.

Liberum upgrades Card Factory, highlights Asos and UK election fallout

With the retail sector now at a major strategic crossroads, investors should back companies that are best prepared for a world where data will be the new frontier, said Liberum, picking out several 'key long-term winners' including Asos, Joules and Ted Baker.

Telit Communications hires SAP's Shawn Reynolds as chief marketing officer

Internet of things company Telit Communications has appointed Shawn Reynolds chief marketing officer.

AB Foods outlook sweetens despite Primark margin squeeze

Profits surged at Associated British Foods in the first half of the year as the sugar business turned a corner and Primark opened 16 new clothes stores across eight countries, lifting management's hopes for the full year.

Drop in March euro area core CPI confirmed

The cost of living in the euro area declined sharply last month as prices for unprocessed foods and energy came off the boil.

IBM earnings beat target but revenues disappoint

US technology giant International Business Machines Corp fell 5. 37% in after-hours trading on Tuesday after it posted a fall in revenue for the 20th consecutive quarter.

Fenner swings to profit, sees FY operating profit ahead

Fenner swung to a profit in the half year ended 28 February as revenue rose and the group grew its market share.

US WTI futures edge higher despite rise in gasoline stocks

US crude oil futures edged higher as traders waited for the release of the latest official US weekly inventory data, while digesting figures from the day before showing a smaller than expected fall in stockpiles.

Aveva eyes return to profit growth due to weak pound

Aveva Group, the engineering software provider, said its full year results will show a return to growth in revenue and profit, helped by currency movements.

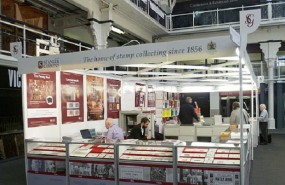

Stanley Gibbons sells rare Indian stamp for record price

Stamp specialist Stanley Gibbons has sold one of the rarest pieces of Indian philately to a private collector-investor in Australia for a record £500,000.

Great Portland confirms special dividend after Rathbone Square sale

Great Portland Estates confirmed it will pay shareholders a special dividend of 32. 15p per share and will effect a 19-for-20 share consolidation at the same time.

White House tax reforms delayed, not dead, BofA-ML says

The White House's push on tax reforms will ultimately succeed, although it may be delayed, meaning interest rate markets were being overly pessimistic, strategists at Bank of America-Merrill Lynch argued.