Market Pulse - Commodities

Director dealings: South32 director acquires shares

South32 revealed on Friday that non-executive director Keith Rumble had acquired 35,700 ordinary shares in the London-listed mining and metals company.

Berenberg lowers target price on John Wood Group despite 'sound' progress

Analysts at Berenberg lowered their target price on shares of energy services company John Wood Group from 590p to 540p on Friday, but said the company's underlying progress over the first half of 2019 was "sound".

Tesla jumps after China grants purchase tax exemption on 16 models

Shares in Tesla were up on Friday after China's Ministry of Industry and Information Technology said that it would exempt 16 of the US car manufacturer's electric vehicle models from its purchase tax.

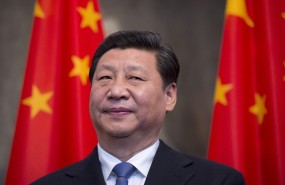

Xi Jinping rejects Philippines' territorial claims in South China Sea

Chinese President Xi Jinping rejected Filipino claims to territory in the South China Sea in a bilateral meeting with President Rodrigo Duterte on Thursday.

BofA-ML sees 'contrarian' signal to buy shares, despite risk of bond bubble bursting

A widely-followed market timing indicator flipped into a 'buy' signal on Thursday, pointing to better than even odds, albeit not by much, of a near-term rally in stocks, although bonds were most likely set for a correction.

ECB's Lautenschlager argues against restarting QE

Sabine Lautenschlager became the third member in as many days at the end of the week to argue against the European Central Bank restarting its quantitative easing programme, saying that there were no signs yet of deflation and warning of the risk of 'moral hazard' by setting the wrong incentives for governments.

China lodges protest over new US tariffs but refrains from immediate response

China lodged a formal protest against the latest round of trade tariffs announced by the US but said that for the moment being it would refrain from a like-for-like response, although a meeting between trade officials from both sides in September had yet to be confirmed.

WTI futures gain after DoE reports sharp drop in weekly stockpiles

Commercial stockpiles of crude oil and products in the US dropped sharply during the latest reference week on the back of a large fall in net imports.

Primark set to train 160,000 cotton farmers to improve sustainability

Primark announced plans to train 160,000 cotton farmers in India, Pakistan and China on environmentally friendly farming methods by 2022 in a bid to improve the sustainability of its operations.

Director dealings: Amur Minerals director purchases shares

Mineral exploration and resource development firm Amur Minerals revealed on Tuesday that non-executive director Thomas Bowens had purchased 7. 52m ordinary shares in the AIM-listed firm.

Diversified Gas and Oil agrees to acquire two US-based natural gas gathering systems

Diversified Gas and Oil has entered into binding agreements to acquire two separate packages of "margin enhancing" natural gas gathering systems in the US.

RBC raises target price on Polymetal despite 'small miss' in H1

Analysts at RBC Capital Markets upped their price target on FTSE 250-listed precious metals mining firm Polymetal on Tuesday, emphasising that a strong second half appeared to lay on the horizon.

Iran steps back from nuclear deal talks with US

Iranian President, Hassan Rouhani, reversed course on the possibility of holding talks with the US on a new nuclear deal until Washington lifts "all illegal, unjust and unfair sanctions imposed on Iran".

AFC Energy fuel cells pass 12-month longevity milestone

AFC Energy on Tuesday successfully achieved twelve continuous months of operation of its fuel cell electrode and said it is on track to achieve targeted electrode longevity.

Proton Power Systems launches electronic vehicle charging joint-venture

Proton Power Systems on Tuesday entered into a joint-venture agreement with Schäfer Elektronik, with the two new partners aiming to build an integrated plug and play power unit.

Wall Street reels after US President says he will respond to Chinese counter-tariffs

Wall Street was left reeling at the end of the week after the US President upped the ante in his trade war with China following Beijing's decision to retaliate against the latest measures threatened by Washington.

Week ahead: US-China trade, German data in focus

The focus over the coming week will likely continue to be squarely on the US-China trade war, with investors trying to digest Washington's likely next move in the 'tit-for-tat' trade war even as negotiators from both sides continue to hold consultations ahead of another round of face-to-face talks in September.

Monetary policy may not be ideal tool against trade disruptions, Fed's Powell says

Monetary policy might not be the best tool to address the impact of trade wars, although it might help to offset some of their effects, which might prove to be transitory, the head of the world's most important central bank, the US Federal Reserve, said.

Commodities: Energy and metals futures soften amid Fed doubts

Commodity prices were on the backfoot on Thursday, with weakness in energy and metals futures offsetting a small bid in the agricultural space.

Premier Oil announces intention to sell Zama alongside record output

Premier Oil surprised markets on Thursday, announcing its intention to sell its stake in the Zama field offshore Mexico in a bid to further reduce its debt pile.