Market Pulse

US close: Stocks end in the black; Dow and S&P 500 hit fresh records

US stocks ended in the black on Tuesday as oil prices advanced and investors welcomed signs of further central bank stimulus, following better-than-expected earnings from industrial bellwether Alcoa.

Arria NLG secures two new pilot programmes

Arria Natural Language Generation (NLG) announced on Tuesday it secured two paid pilot programmes from within the financial services industry for its NLG software technology.

Sanders endorses Clinton after long battle for Democratic presidential nomination

Bernie Sanders has finally endorsed Hillary Clinton for the US Democratic presidential nomination after appearing with his former rival on Tuesday in a high school gym in Portsmouth, New Hampshire.

Jamie Dimon planning to tackle income equality at JP Morgan & Co.

Chief Executive of JP Morgan & Co. Jamie Dimon said on Tuesday that he plans to raise the wages of the investment bank's employees, in order to address wage stagnation and income inequality.

Small caps news round-up

Somero Enterprises said on Tuesday that its full-year results are likely to be slightly ahead of market views thanks in part to a strong performance in June. The company, which manufactures technologically-advanced concrete placing equipment, said trading in June was much stronger than in May and the same month last year thanks to solid activity in North America.

Bonds: Gilts edge higher amid stimulus

Gilts retreated slightly at the start of the week, but not before an initial surge that sent their yields to fresh record-lows on an intraday basis at 0. 71%.

US open: Stocks gain on oil price rebound, earnings season

US stocks gained on Tuesday as oil prices rebounded and Alcoa kicked off the new earnings season with better-than-expected second quarter results.

Citigroup stock climbs after Venezuelan account closures

Stock of Citigroup rose in premarket trading on Tuesday after the company announced it would be withdrawing foreign accounts in the South American region of Venezuela.

Director dealings: St Modwen scion Clarke places hefty bet

Simon Clarke on Tuesday became the third director of St Modwen Properties to buy shares as Brexit worries about the property sector sent the regeneration specialist's shares to their lowest level in three and half years.

Nintendo's Pokemon success suggests 30,000 yen target price, says Jefferies

Broker Jefferies reiterated its 'buy' rating on Nintendo even after the company's shares leapt 36% over two days on the back of excitement around the roll-out of the Pokémon Go smartphone game.

Oracle rises on back of BMO Capital upgrade

Cloud application provider Oracle's stock climbed higher on Tuesday after receiving an upgrade from BMO Capital.

Somero Enterprises FY to be slightly ahead of views

Somero Enterprises said on Tuesday that its full-year results are likely to be slightly ahead of market views thanks in part to a strong performance in June.

Benchmark Holdings signs 10-year deal with salmon producer

A subsidiary of Benchmark Holdings’ breeding and genetics division, SalmoBreed, has signed a ten-year agreement with one of the world’s top three salmon producers for the supply of the SalmoBreed genetic stem into its production sites.

AMC Entertainment to buy Odeon & UCI Cinemas in £921m deal

AMC Entertainment Holdings has agreed to buy London-based Odeon & UCI Cinemas Group from private equity firm Terra Firma in a deal worth around £921m.

Rathbone Brothers surges on Numis upgrade

Rathbone Brothers shares surged on Tuesday as Numis upgraded its stance on the stock to ‘buy’ from ‘add’, with a 2,350p price target.

Quantum Pharma CEO Scaife steps down, trading in line

Quantum Pharma chief executive Andrew Scaife has stepped down after seven years but is leaving the company with current trading running in line with management expectations.

C4XD acquire new drug discovery technologies

Drug discovery and development company C4X Discovery Holdings (C4XD) announced on Tuesday the acquisition of advanced drug discovery technologies from MolPlex Technologies.

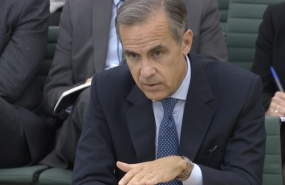

Bank's Carney denies 'Brexit scare story' allegations, explains FPC thinking

Bank of England Governor Mark Carney has explained high street bank's capital buffers have been relaxed to help reassure the public that the 2008 credit crunch was not about to be repeated, while also denying that he was used by the Prime Minister and Chancellor to "scare" voters from voting to leave the EU in June's referendum.

RhythmOne confident online ads will escape Brexit effect

Online advertising agency RhythmOne, which changed its name from Blinxx in June, expressed confidence about returning to full year profitability and played down the effects of Brexit as trading in the first quarter "materially" beat expectations.

Orchard Funding falls below IPO price after regulatory delays, hiring hitch

Insurance premium financing specialist Orchard Funding warned that it had found it difficult to grow lending due to "significant" regulatory delays stemming the flow of new insurance broker customers into the market and the slow process of recruiting suitable senior salespeople.