Market Report

JP Morgan upgrades UK stocks because of their defensive qualities

Strategists at JP Morgan upgraded their recommendation on UK stocks, touting the 'defensive' qualities of British shares, expectations for better performance from commodity sectors, limited upside for sterling and record cheap valuations on some metrics.

Investec upgrades OneSavings Bank to 'buy'

Investec upgraded OneSavings Bank to 'buy' from 'hold', keeping the price target at 455p.

Europe open: Stocks start the day lower, geopolitical frictions eyed

Stocks are lower at the start of the trading but off their worst levels with investors seemingly hesitant to keep pushing stocks higher despite relatively buoyant data out of France.

Sula Iron & Gold signs new contract with Equity Drilling

AIM-listed gold exploration company Sula Iron & Gold has signed a new 5,000m drilling contract with Equity Drilling on its flagship Ferensola gold project.

Blancco Technology chairman Rob Woodward to step down

AIM-listed Blancco Technology said on Tuesday that Rob Woodward will step down as chairman and from the board around the time of the company's full-year results in October.

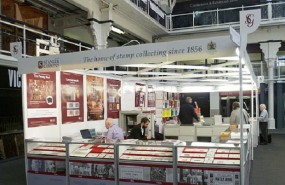

Stanley Gibbons sells 25% interest in Masterpiece for £1.4m

Stamp and coin specialist Stanley Gibbons has sold its 25% interest in Masterpiece, the operator of the annual Masterpiece London art and antiques fair, to Masterpiece for a total consideration of £1. 4 million payable in cash.

London open: Stocks in the red; IAG tanks on BA chaos

London stocks were weaker in early trade, with IAG suffering the heaviest losses following an IT outage at British Airways that has caused three days of disruptions for passengers.

LSE to buy Citi's fixed income analytics platform and index family

London Stock Exchange Group has struck a deal to buy a fixed income analytics platform and family of fixed income indices from US bank Citigroup's for $685m (£535m) cash.

Witan consolidates, drops two external managers

Following a review of its five managers with a global equity remit, Witan announced on Tuesday that it had decided to consolidate the previous five portfolios into three, under the management of three of its existing managers.

International PPL performance 'fully in line'

Global infrastructure project investment company International Public Partnerships Limited updated the market on its portfolio performance for the period from 1 January to 26 May on Tuesday, with the board claiming its portfolio of 127 investments in regulated and public infrastructure projects was performing fully in line with expectations.

Intu brings TH Real Estate as partner at Madrid Xanadu

Shopping centre operator Intu Properties announced on Tuesday that both itself and TH Real Estate - on behalf of its pan-European investment vehicle, the European Cities Fund - had agreed to form a joint venture to own Madrid Xanadú shopping centre in Spain.

Anglo American completes sale of interest in Dartbrook, LSE to buy Citi indices and analytics business

London open.

McCarthy & Stone appoints John Tonkiss as CFO

Retirement housebuilder McCarthy & Stone has appointed John Tonkiss as its group chief operating officer with effect from 1 June.

London pre-open: Stocks seen lower after the long weekend

London stocks looked set for a weaker open after the bank holiday weekend.

Tuesday newspaper round-up: Clearing clash, ports puzzle, CBI criticism

One of the eurozone’s top central bankers has stepped up the campaign to claim the City’s lucrative euro-clearing business by declaring that it is impossible for it to remain in London. François Villeroy de Galhau, a member of the European Central Bank’s governing board and head of France’s financial regulator, made the statement as the European Commission worked on proposals intended to force euro-denominated derivatives to be cleared in the eurozone. - The Times.