Latest News

Looser controls on margin trading drive gains in Chinese stocks

Chinese stocks closed higher at the start of the week, boosted by Chinese policy-makers´ decision to loosen controls on margin trading.

London open: Mining stocks lead FTSE 100 lower

UK stocks declined on Monday, led by mining shares as commodity prices declined.

Europe open: Stocks slip as oil prices slide

European stocks slipped in early trade following a mixed session in Asia, as oil prices declined and investors awaited fresh catalysts at the start of a shortened trading week.

Jefferies downgradesTullow, upgrades Soco International

Jefferies downgraded Tullow Oil to ‘underperform’ from ‘hold’ with an unchanged price target of 166p.

Ian Kellett to take the helm at Pets at Home

Pets and Home Group announced the appointment of Ian Kellett as its chief executive officer on Monday, taking the helm from 4 April.

Tungsten rejects Truell offer as he resigns from board

Payments invoicer Tungsten Corp said on Monday that it has rejected an offer from former chief executive Edi Truell, who has now resigned from the board.

London pre-open: Stocks seen lower as investors await fresh catalysts

London stocks are set to open lower on Monday as investors look for fresh catalysts at the start of a four-day week.

Weak gold price hits FY profits at Centamin

A weaker gold price hit full year profits at miner Centamin, which fell to $58. 4m from from $81. 5m despite a jump in revenue to $508. 4m from $472m.

Synthomer buys US-based Hexion; Centamin profits fall

London’s FTSE 100 is seen starting 28 points lower than Friday’s close at 6,162.

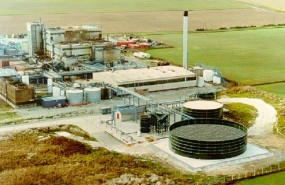

Synthomer agrees to gobble up Hexion

FTSE 250 specialty chemicals company Synthomer announced the $226m (£156m) acquisition of Hexion Performance Adhesives & Coatings on Monday morning, to be completed this summer following regulatory approval and other conditions.

Monday newspaper round-up: Brexit, Dyson, BHS, sugar tax, Barclays

The UK economy could lose more than half a million jobs by 2020 in the event of a vote to leave the EU and would be unlikely to recover from the impact fully even after 15 years, the head of the CBI is set to warn. Carolyn Fairbairn, director-general of the business lobby, will present research by PwC, the professional services firm, suggesting the shock of a British exit could cut economic output between 3 and 5. 4 per cent in 2020, depending on what sort of deal Britain managed to negotiate with its trading partners.

FX round-up: US dollar RSI pointing towards possible bounce

Cable ended the session little changed as a semblance of calm returned to foreigh exchange markets after a week marked by heavy selling in the US dollar which drove a key technical indicator deeply into 'oversold' territory - possibly heralding that at least a bounce might be in the offing.

Bonds: Odds of Fed rate hike by mid-2016 drift lower

These were the movements in the most widely followed 10-year sovereign bond yields:.