Market Pulse - Commodities

Fed´s Rosengren reiterates call for rate hike

The US economy was near full-employment with inflation close to the central bank´s target, so the Federal Reserve should raise rates, a top monetary policy maker reportedly said.

Commodities: Chinese trade data knocks copper futures lower, but little else

Weaker than expected trade data out of the People's Republic of China left a dent in copper futures but not much else on Thursday, with a pull-back in the US dollar possibly helping to steady traders' nerves.

Weekly US oil inventories jump, push WTI futures higher

US crude oil stockpiles jumped last week, pushing crude oil futures higher, albeit alongside sharp drops in product inventories.

Commodities: OPEC´s production hits highest level since at least 2008

Commodity prices slid lower, with agricultural and energy futures registering the steepest declines.

Saudi Arabia may need to cut more, IEA says

Faced with higher output from Libya, Nigeria and Iran, bigger production cuts from Saudi Arabia will be necessary in order for OPEC to meet its informal target of capping their crude oil supplies at between 32. 5m to 33. 0m barrels a day, the rich world's energy watchdog said according to reports.

Commodities: Brent futures hit one-year high, cocoa down

Russian support for an oil output cut or freeze set the energy patch alight at the start of the week.

Sector movers: Miners, Big Oil lead to the upside

Cyclicals gained and defensive issues fell back as markets reacted to the results of the latest televised US presidential debate overnight, amid positive news-flow for the commodities space.

Russia ready to join oil production freeze, Putin says

Crude oil futures moved higher after Russian president Vladimir Putin signalled from Istanbul that his country was willing to join a freeze on production.

Demand for energy will peak in next 14 years, World Energy Council says

Worldwide energy demand for transport fuel, heating and electricity will peak before 2030, according to a major study by academics, energy companies and the public sector, though positive scenarios are seen for oil and solar and wind energy.

S&P maintains A- rating for Saudi Arabia long-term debt

Standard & Poor's has affirmed an 'A-/A-2' rating for the Kingdom of Saudi Arabia and maintains that the outlook for the oil exporter is stable.

Brexit marked low-point for bond yields, BofA Merrill says

Brexit marked the 2016 low for bond yields, strategists at Bank of America-Merrill Lynch said in a report titled "The Day QE died", although fixed income - albeit not those for Treasuries - continued to see large inflows of clients´ funds.

US crude oil inventories fall in latest week, DoE says

Gasoline stockpiles in the US registered an unexpected drop in the latest week, pressuring crude oil futures higher.

Commodities: Dollar strength pushes precious metals sharply lower

Strength in the greenback piled pressure on commodities, especially in the precious metals space.

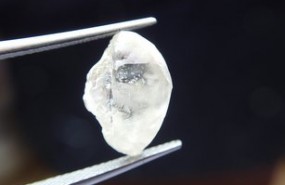

Anglo American sees solid De Beers rough diamond demand

Anglo American said sales at its De Beers diamond business were not as quiet as expected in the eighth sales cycle of the year.